Fundi balance check: A step-by-step guide for students

Fundi offers a convenient way to handle your education finances if you are pursuing higher education in South Africa. While anyone can apply for these funds, sometimes students face challenges when trying to know how much they have available. This guide will take you through the Fundi balance check process, ensuring you stay on top of your finances and focus on your studies.

Source: UGC

TABLE OF CONTENTS

Fundi has been supporting students in their education pursuits since the 1990s. Unlike NSFAS, their funding is given in the form of loans, which should be repaid with interest. Understanding the Fundi balance check process ensures students use the funds effectively to cover educational expenses like tuition fees and accommodation and purchase the required learning tools.

How do you check your balance on Fundi?

Fundi balance check is a straightforward process that ensures easy monitoring of your educational finances to avoid misuse. It can be done using any of the following five ways;

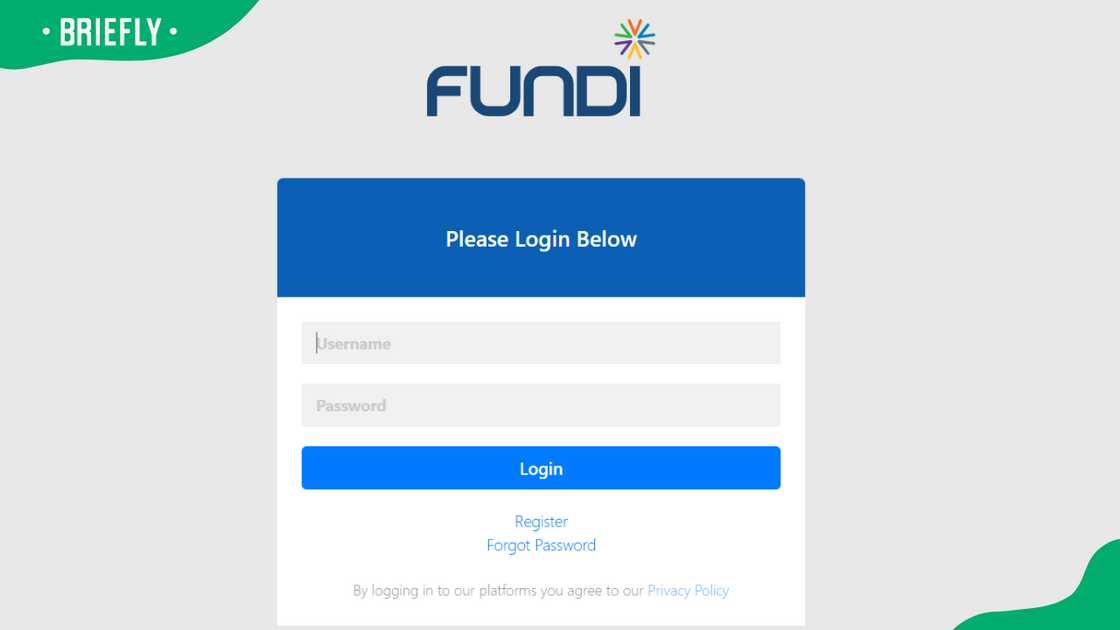

1. Via website

- Visit the Fundi website at fundi.co.za.

- Select the Login option found in the top right corner, then click on Student Login.

- If you have an account, provide the Username and Password to access it.

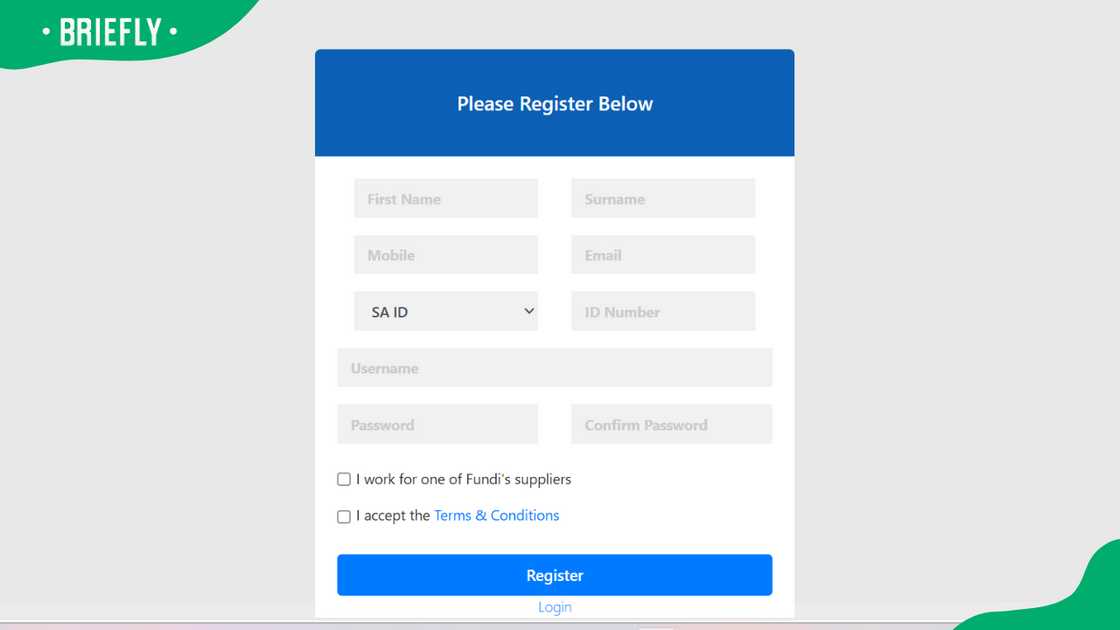

- If you do not have an account, click on Register.

Source: UGC

- In the window that appears, fill in the requested information, including your personal details and contact information.

- A one-time password will be sent to your phone number. Enter the OTP to verify your registration.

- Create a strong password

- Follow the prompts to complete your registration.

- Log into your account to view the balance.

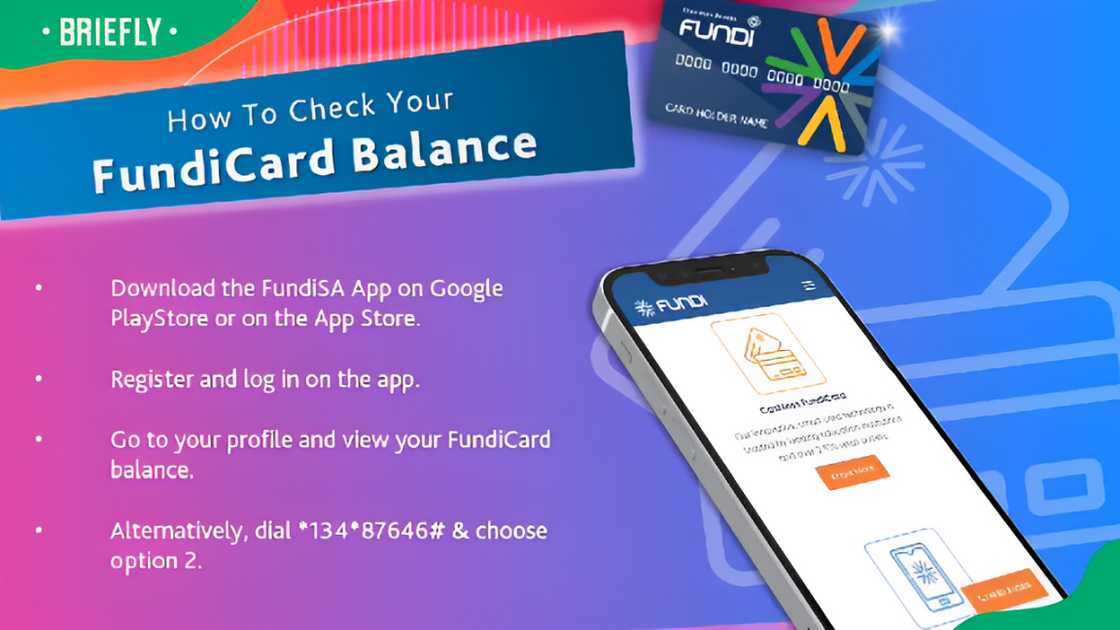

2. Via FundiSA App

- Download the FundiSA App on the Google Play Store or the App Store

- Register, then log in to the app

- Head to your profile, where you will view your FundiCard balance

Source: UGC

3. Via USSD

To check your balance using the USSD code on your mobile phone, dial *134*87646#, then choose option 2. This process does not require you to have airtime or data.

4. Via call centre

If you are having trouble accessing your Fundi balance online or via mobile, you can reach out to their call centre. The number for balance enquiries is 0860 44 33 44.

5. At the campus office

Fundi has several branch offices located within university campuses across South Africa. Students who have issues with viewing the balances can walk into these offices and seek assistance. Ensure you take your ID or passport with you.

How to check Fundi banking details?

Once you have applied for a Fundi loan, you will receive cash and transport allowance via EFT into your personal bank account. You must ensure your banking details are correct to avoid encountering problems when using your FundiCard. Follow these steps to verify the information;

- Go to the FundiCard student portal at 'mycard.fundi.co.za.'

- Log in by entering your username and password in the window that appears. If you do not have an account, register by entering your personal details like ID number, student number, and cellphone number.

Source: UGC

- You will receive a one-time password on your phone. Enter the OTP to proceed.

- In the window that appears, click on Banking Details to verify your banking information.

How to download a Fundi statement?

Downloading your Fundi statement helps you keep track of your educational expenses and loan balances for better budgeting. It also allows you to verify that all transactions are accurate. To download statements, follow these steps;

- Go to Fundi's official website

- Log in to your student account by entering your username and then your password. If you do not have an account, click on Register, then fill in the requested details.

- Once you are on the dashboard, navigate to Statements, where you will see the download button.

How to get a FundiCard

FundiCard is a payment solution that allows students to manage their educational expenses more conveniently. To receive and activate your FundiCard, follow these steps;

- Visit the nearest Fundi office with your original ID or passport

- After your ID is verified, a Fundi representative will provide you with your FundiCard.

- They will assist you in activating it by swiping the card on the Fundi terminal and entering your student number / ID number.

- You will then need to set a PIN for your card and confirm it by re-entering the PIN.

- Once this process is complete, your card will be registered and ready for transactions.

Source: UGC

Where can you use your FundiCard?

You can use your FundiCard at various retail partners across South Africa. Some of the main places include Shoprite, Checkers, PicknPay, Selected Spar outlets, Nando's, Gallitos, campus shops, and KFC.

These outlets allow you to purchase textbooks, accommodation, food, and study tools. The card is designed to help manage your spending on and off campus by dividing funds into different categories or pockets for specific uses.

Is Fundi related to NSFAS?

Fundi and NSFAS are not the same thing, although they both offer financial assistance to students in South Africa. NSFAS is a government-funded scheme that provides bursaries to academically deserving students from disadvantaged backgrounds to cover tuition fees, accommodation, study materials, and a living stipend.

NSFAS offers a flexible repayment plan that depends on your income threshold. The funding is usually provided as bursaries, which do not need to be repaid.

Fundi is a private financial services provider that offers student loans and other financial products. Unlike NSFAS, Fundi's loans need to be repaid with interest. Fundi is not limited to underprivileged students and covers a wider range of educational programs, including postgraduate studies.

Source: Getty Images

Understanding the above Fundi balance check is important if you want to focus on your studies without financial stress. Keeping track of your finances is a critical aspect of managing your educational journey.

READ ALSO: How to reapply for NSFAS: All you need to know about re-registering

Briefly.co.za highlighted all you need to know about how to reapply for NSFAS. The scheme allows returning students or those whose initial application was unsuccessful to seek financial support to fund their education.

A student must ensure they meet all the requirements for reapplication to avoid rejection. Check the article for a detailed guide on how to re-register for NSFAS successfully.

Source: Briefly News