How to increase your limit on TymeBank: Everything you need to know

Responsible money management means monitoring how much goes in and out of your account. Bank limits ensure you do not spend recklessly within a short period. How do you increase your bank limit? This article discusses how to improve your limit on TymeBank for TymeBank customers and other essential information about the process.

Source: UGC

TABLE OF CONTENTS

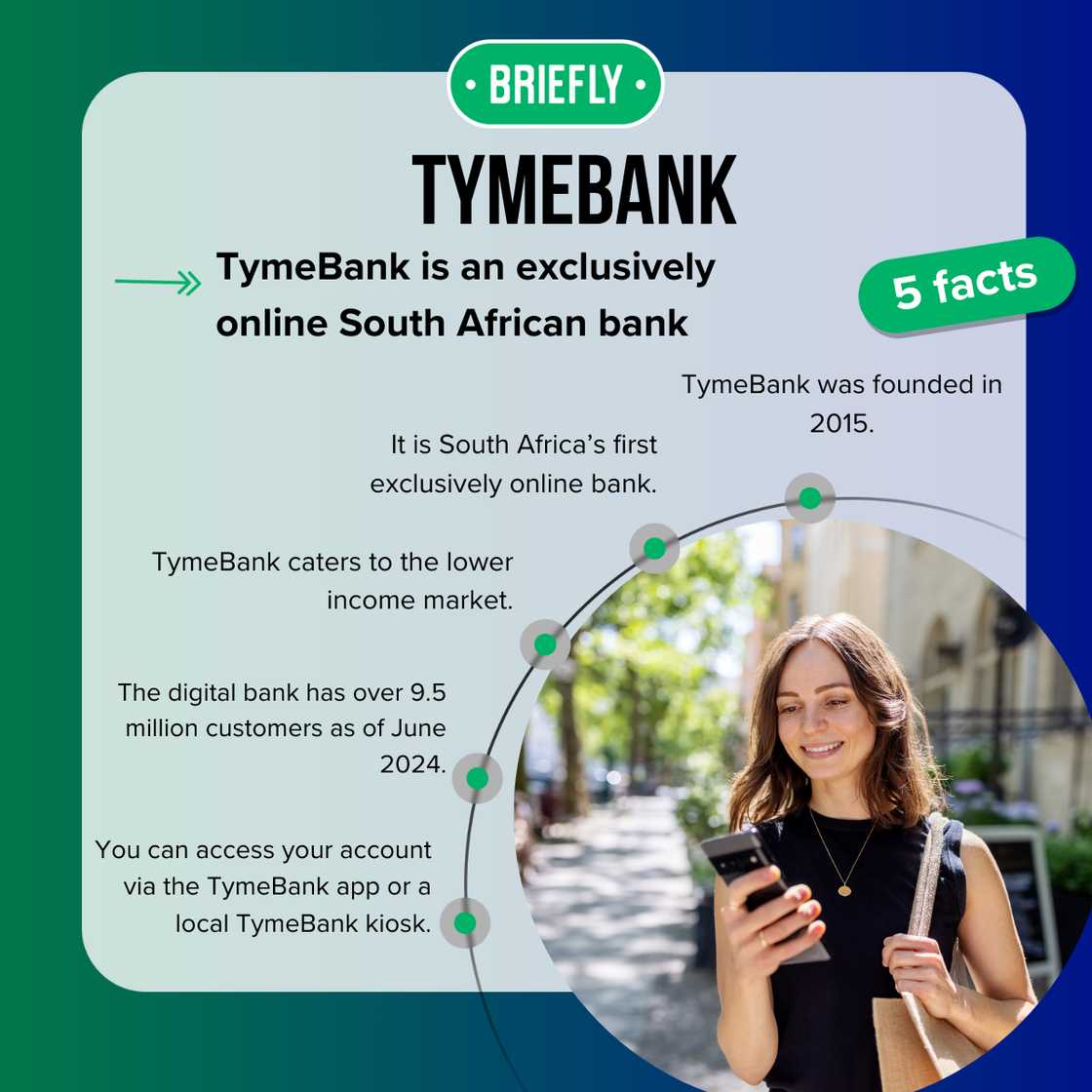

Founded in 2015, TymeBank is an exclusively online digital bank based in South Africa aimed at individuals in the lower-income market. It is also South Africa's first solely online bank, saving customers time by not having to visit a local branch and spend hours waiting for assistance.

The digital bank provides all the functions of other traditional banks, including daily limits. Your TymeBank daily limit assists you in sticking to the money-saving goals you have set for yourself. Knowing how to upgrade your TymeBank account helps you maintain your finances while altering them as and when needed.

How to increase your limit on TymeBank

If you want to increase your limit on your TymeBank profile, you can change the TymeBank withdrawal limit on your account in various ways, including:

- At your local TymeBank kiosk.

- Via the digital bank's app.

Source: Original

How to increase your daily limit on TymeBank without the app

You can increase your daily limit on TymeBank even if you do not have online banking. According to Tymebank's FAQ website, here is how to increase your TymeBank transaction limits without the app:

- Step 1: Visit the closest TymeBank kiosk near you.

- Step 2: Utilise your TymeBank login details to access your bank account.

- Step 3: Select 'Unlock more features' on the display.

- Step 4: Enter the relevant information asked to confirm your identity and details.

- Step 5: Increase your daily limits as you wish.

How do you increase your TymeBank limit on the app?

You can also increase your limits on the bank's smart app if you have it. Here is how to increase your limit on the TymeBank app:

- Step 1: Download the TymeBank app from Google here if you have not already done so.

- Step 2: Enter your login details to access your account.

- Step 3: Update or confirm your biometrics if necessary.

- Step 4: Navigate to the 'Unlock more features' section.

- Step 5: Enter the relevant information requested to verify your information.

- Step 6: Update your limits to your preferred value.

Source: UGC

Does TymeBank have a daily limit?

As mentioned, all banks have a daily limit, and Tymebank is no exception. Each customer chooses this limit, but the value may not be unlimited.

What are TymeBank's payment limits?

Increasing your daily limit with TymeBank is quickly done through the above-mentioned methods. However, the highest value you may choose is a daily limit of R2,000. This limit includes:

- Payments

- Sent money

- Prepaid purchases

- Card swipes

- Cash withdrawals

- Online purchases

How to your check limit on the TymeBank app

If unsure of your limits, follow the steps above to display your current limit cap. Then, you may change the limit to your preferred value.

How to change your TymeBank phone number

Your cell phone number is directly linked to your account and is essential for accessing your profile or changing relevant details. According to the digital bank's FAQ page, here is how to change your current number:

- Step 1: Visit one of your local kiosks.

- Step 2: Open your account using your login details.

- Step 3: Select 'My profile' and 'My details'.

- Step 4: Select the 'Change number' option and enter your new number.

- Step 5: Verify your new number by confirming the OTP pin.

Source: UGC

Where can you find Tymebank's kiosks?

If you do not have the banking app, you can access your account and update your details at the following locations:

- Pick n Pay

- Boxer

- TFG stores

Frequently asked questions

Now that you know how to update your daily limits with the digital bank, what else is there to know as a customer? These are the most commonly asked questions by the South African bank's customers.

How can you get your bank statement and proof of account verification?

To access your statements, you must do the following:

- Step 1: Log in to your internet banking or smart app.

- Step 2: Select the 'Everyday account' option.

- Step 3: Select the 'Account information' option.

- Step 4: Select the 'Statements or proof of bank account' option.

- Step 5: The documents will be sent to your email address.

If you do not have an email address linked to your account, you can add one to your profile by selecting the 'Profile' icon and choosing 'Change email.'

Can you reverse a SendMoney transaction?

The SendMoney feature helps clients transact with only the recipient's cell phone and adequate funds in their account. These transactions cannot be reversed; however, if the deposit is not withdrawn within seven days, the voucher expires, and the money is automatically returned to the sender's bank account.

How long does it take for deposits from another bank to reflect?

Money sent to and from other banks via EFT can take 24 to 48 business hours to reflect. If the funds are urgent, you can use the digital bank's instant EFT option, which may be subject to extra banking fees.

Contact details

You can contact the bank on their TymeBank WhatsApp number, 086 0999 119. You can also email them via service@tymebank.co.za.

Knowing how to increase your limit on TymeBank helps you manage your money as it changes, keeping you on top of your finances. The digital bank's own R2,000 also assists customers in keeping their spending down to a minimum.

DISCLAIMEminimum article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help. It should not be relied on to make decisions or actions you take upon the information presented in this article is strictly at your own risk and responsibility!

READ ALSO: How to register for Absa online banking: Detailed guide

Absa is one of South Africa's biggest banks, with over 12 million clients nationwide. Briefly.co.za wrote about how existing and potential new clients can register to do online banking.

How can you register for Absa online banking? Read on for a detailed step-by-step guide.

Source: Briefly News