SASSA funeral benefits explained: What happens when a grant recipient passes away

The local government entity SASSA offers assistance with funeral cover to South Africans, providing much-needed assistance in the event of a worst-case scenario. Some SASSA funeral benefits include covering tombstones, burial services, and repatriation where necessary, but the finances are not directly provided by the organisation.

Source: Facebook

TABLE OF CONTENTS

- Key takeaways

- SASSA funeral benefits offer grieving recipients financial relief via third-party coverage

- SASSA does not provide monthly payments after a client's death

- Knowing how to claim SASSA funeral benefits alleviates some stress from receipts during a time of loss

- Frequently asked questions

- SASSA funeral benefits contact details

Key takeaways

- The South African Social Security Agency (SASSA) was established by the South African Social Security Agency Act, 2004, and came into effect on November 15, 2004.

- SASSA's funeral benefits do not stem from cover options by the entity, but rather, are offered by third-party insurers.

- SASSA death benefits help loved ones cover funeral and burial costs if the claimants provide the necessary documentation.

- Knowing how to claim a funeral benefit alleviates stress from grieving loved ones by simplifying the process.

SASSA funeral benefits offer grieving recipients financial relief via third-party coverage

SASSA does not offer cover options within their own capacity. Instead, the organisation enables beneficiaries to establish a private funeral cover option of their choosing, which can be deducted from their SASSA grant.

Read also

A TikTok video highlighted short safety courses in South Africa as a pathway into safety officer jobs

The organisation facilitates the payout of unclaimed benefits to cover burial costs if the deceased individual's grant was active within the month of their death, but was not collected.

Source: UGC

SASSA does not provide monthly payments after a client's death

The government entity does not offer monthly payments for any of its funeral cover options. Instead, SASSA offers a once-off funeral payout. The remaining value of the deceased's unclaimed grant is paid out as a lump sum, which is used to cover their funeral costs. Those collecting the grant must provide a receipt and a funeral invoice, amongst other documents, to claim.

Knowing how to claim SASSA funeral benefits alleviates some stress from receipts during a time of loss

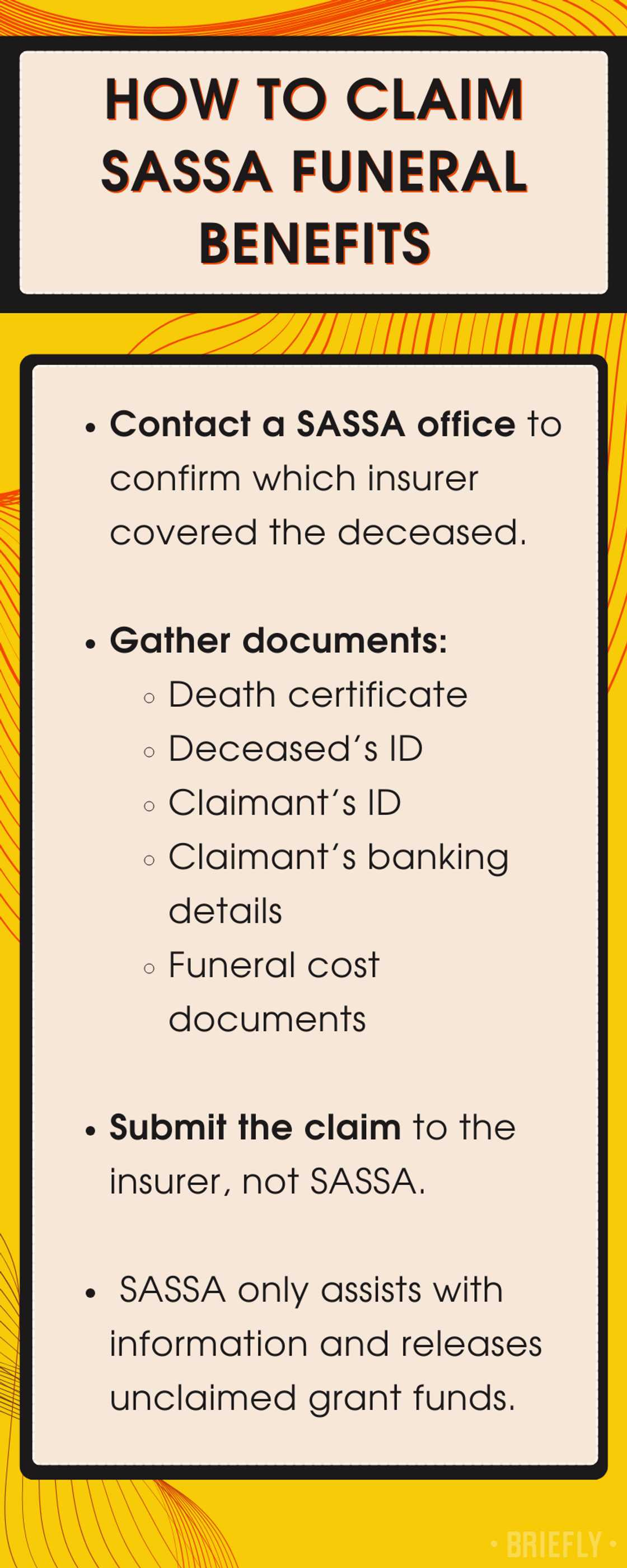

Those who want to claim the benefits may follow these instructions:

- Contact your nearest SASSA office: Loved ones must confirm via SASSA which insurer covered the deceased recipient before they may withdraw funds if they do not already know.

- Collect the relevant documentation: Obtain the deceased's death certificate, their ID, the claimant's ID, the claimant's banking details, and documents relating to funeral costs.

- Submit your claim: Individuals must submit their claim to the relevant insurer and not SASSA, as their role is to provide information, assist in the claims process and payout any SASSA benefits not already claimed that month.

Read also

"You'll feel rich": Digital nomad asks Mzansi what lifestyle he can live with R5.1m annual salary

Source: UGC

Frequently asked questions

Families of deceased grant recipients may still have questions surrounding the process, such as who qualifies to claim and how to apply. Loved ones with the necessary documentation may apply for the grant payout, and an application for benefits must be made directly with an insurance company or brokerage.

How can someone apply for a SASSA funeral cover?

As established, SASSA does not offer direct funeral cover. However, those interested in obtaining cover may contact insurance companies directly, or an insurance brokerage company to assist you in finding the appropriate cover for your specific needs.

What happens when a SASSA pensioner dies?

When a pensioner registered with SASSA passes away, their grant is cancelled on the last day of the month in which their death took place, as the system is interlinked with the Department of Home Affairs' population register. Those who still have an unclaimed payment of the month can have a family member collect it with the relevant documentation as proof of identity.

Read also

Gambling Nation? South Africans react to National Treasury's proposed 20% tax on online gambling

Source: UGC

Who qualifies for SASSA funeral benefits?

The following factors determine whether an individual qualifies for SASSA funeral benefits:

- A registered beneficiary: The deceased individual must be a SASSA grant recipient to withdraw any financial benefits after death.

- An unclaimed grant: Funeral benefits may only be collected if they were not already claimed by the deceased person within the month of their passing.

- An eligible claimant: Those who wish to claim the financial benefits must be a legal representative, next of kin, or a family member who organised and financed the funeral.

- Claiming within the qualifying timeframe: All claims must be collected within six months of the deceased's death date.

What grants does SASSA offer?

The following grants are offered to South Africans, which are subject to terms and conditions:

- Disability grant

- Older person grant

- Old age grant

- Child support grant

- Foster child grant

- Grant-in-aid

- Social relief of distress grant

- Care dependency grant

- War veterans grant

SASSA funeral benefits contact details

If you have any further questions or require assistance, you may contact the organisation via the following methods:

- Contact number: 080 060 1011

- Email address: GrantEnquiries@sassa.gov.za

- Website: www.sassa.gov.za

SASSA funeral benefits are not a form of cover offered by the organisation. Instead, they provide grieving families with the opportunity to claim any unredeemed money within the month of the recipient's death if they have not already claimed it. They also assist the family in obtaining a payout from the direct insurer where necessary, helping to alleviate any unnecessary stress during their time of grief.

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions. Any action you take based on the information presented in this article is strictly at your own risk and responsibility.

Read also

SA expats: Department of Home Affairs' simple process to reinstate citizenship has SA divided

READ ALSO: What is the SASSA WhatsApp number? Contact SASSA with ease

Source: Original

Briefly.co.za wrote an article for SASSA customers detailing how you can efficiently contact them. The easiest way to get into direct contact with SASSA is via phone, either their toll-free number or WhatsApp number.

Contacting the organisation via their WhatsApp line offers customers immediate assistance via prompts. Alternatively, customers can call their toll-free line or email them for quick assistance.

Source: Briefly News