“Retirement Isn’t Guaranteed”: SA Reacts to Man’s Complaint About High Tax on R30k 2-Pot Withdrawal

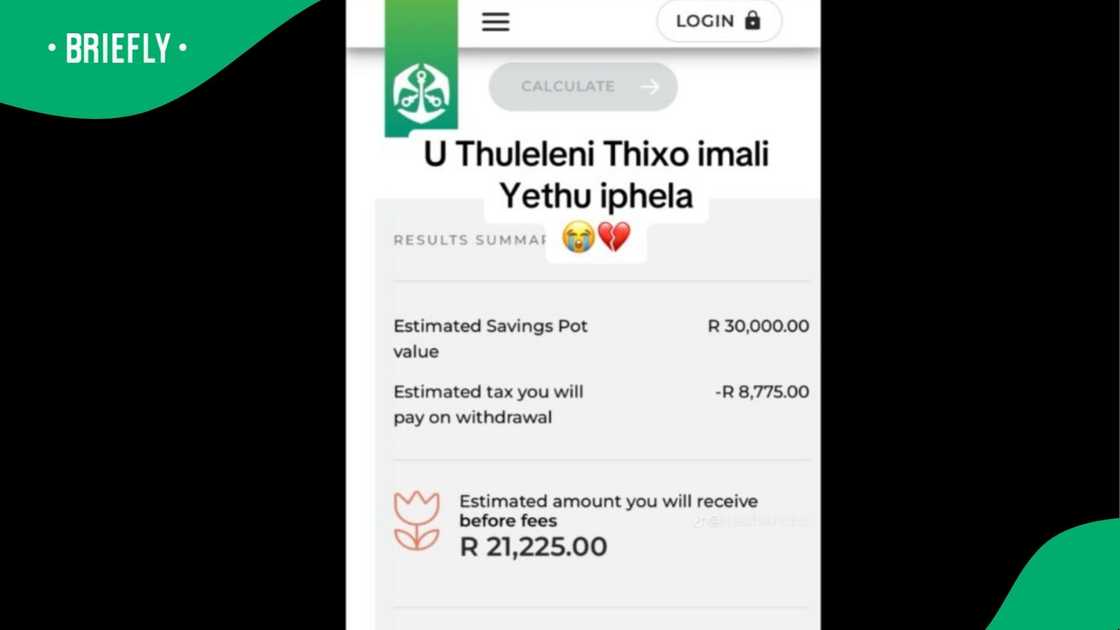

- A local man shared a screenshot of the amount he wanted to withdraw from his two-pot system pension fund

- The picture also showed the total tax deductions, which the man was not too pleased with

- Members of the online community were split in the comment section on whether the man should withdraw his money

- An accounting and audit clerk shared with Briefly News what the two-pot is and how to apply

Source: Instagram

Saving for retirement offers financial security and peace of mind. However, one man who had accessed his pension fund earlier than planned was shocked to discover the significant tax deductions he had faced.

Too much tax on 2-pot

Mbasa Lusawana, who uses the handle @mbasalusawana on TikTok, shared a screenshot of his estimated savings pot value of R30 000. The image also showed that an estimated R8 775 would serve as tax deductions if he had to withdraw the money.

That meant Mbasa would receive R21 225. The total did not please the gentleman at all.

PAY ATTENTION: stay informed and follow us on Google News!

Take a look at the screenshot in the picture below:

Source: TikTok

What is the 2-pot system?

An audit and accounting clerk explained to Briefly News the money-saving system that will be introduced to South Africans on 1 September 2024.

"The two-pot retirement system is a government initiative in South Africa that aims to enhance financial security. Any taxpayer with a pension, provident or retirement fund can participate."

Noting that the maximum amount drawn is R30 000 and that the tax deductions depend on the taxpayer's tax bracket, the clerk added:

"Applications must be made through the institution managing the taxpayer's fund."

Mzansi reacts to tax fees

Thousands of social media users took to the post's comment section to express their thoughts on the tax deduction and share their take on whether Mbasa should withdraw the money now or later in life.

@moosa.shukulyn shared their opinion about those in charge, saying:

"The government is truly against us in all ways."

@leratovilakazi wrote in the comments:

"This is a trap. Please don't do it."

@tbungza, on the other hand, said:

"Take it. Retirement is not guaranteed. Life is short."

@haruki_masana shared their concerns:

"I am worried that the fees are not transparent."

A frustrated @roxeynhlamu_cee commented:

"They will start taxing us for breathing at this rate."

@userwqpwbe3nnl was not a fan of the deductions either:

"The unions are failing us. The government is taking us for a ride. It's daylight robbery."

@jazzb48 said to the online community:

"The problem is we are an understanding and peaceful country. We should have refused this money to be taxed again."

@mbulelosibiya told people:

"I saw my tax. It's just not worth it."

What you need to know about the 2-pot system

The two-pot retirement system lets South Africans tap into part of their retirement savings for emergencies. One third of the funds are available in a savings pot for immediate needs, while the remaining two-thirds are reserved for retirement to provide long-term financial stability.

Read also

"Better days are coming": Mzansi peeps rally behind a graduate after getting a law enforcement job.

Individuals must be at least 55 years old to access retirement savings, and withdrawals must be made as a retirement annuity.

Withdrawals from this component are allowed once per year after an assessment, with a minimum of R2,000. However, these withdrawals will be taxed at the individual's marginal tax rate.

South Africa will roll out the two-pot retirement system from 1 September 2024.

Man rants about tax on 2-pot system

In a related article, Briefly News reported about a man who was not happy with the R8 000 tax deduction on his two-pot system pension fund.

Social media users shared their shock and thoughts in the post's comment section.

PAY ATTENTION: Сheck out news that is picked exactly for YOU - click on “Recommended for you” and enjoy!

Source: Briefly News