"Something Is Off": Accountant Questions Giovanni Ravazzotti's Salary and Tax Deductions

A South African accountant broke down earnings tied to a top business figure, sparking questions about how tax percentages are calculated at the highest levels

The discussion struck a chord in a country where ordinary workers feel the pinch of deductions every month more than ever

The numbers showed just how complex South Africa’s tax system can be, highlighting the wide gap between what the average person pays and what those at the top actually contribute

It revealed just how complicated South Africa’s tax structure is, showing the huge gap between what everyday earners pay and the much smaller proportion some elites contribute, and it left many questioning whether the rules are truly applied equally.

Source: Facebook

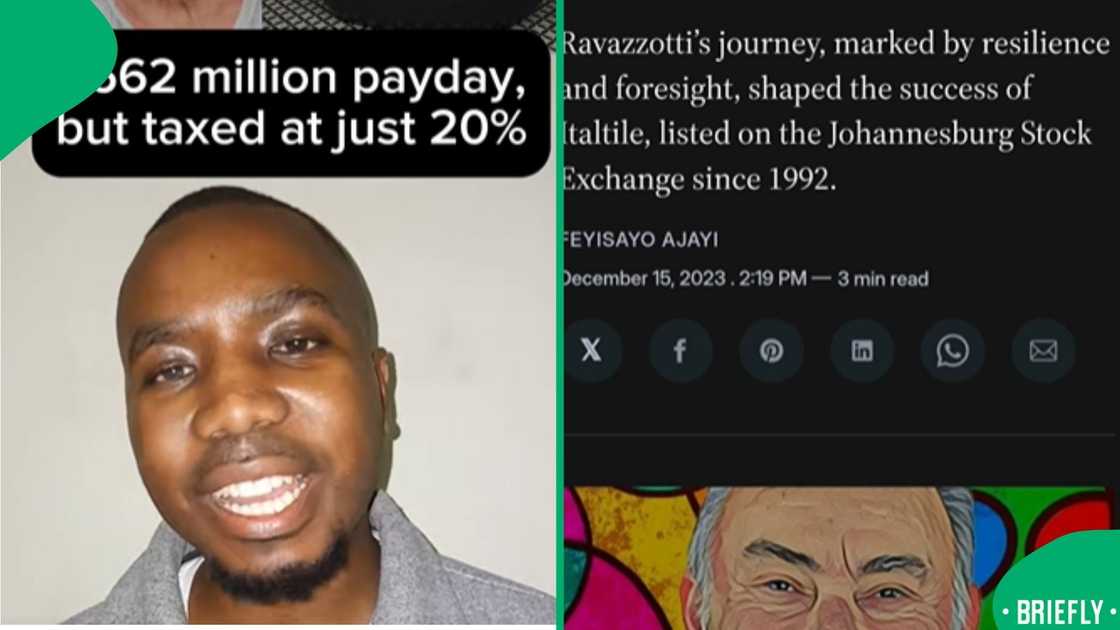

A South African accountant and tax-saving strategist sparked debate after questioning the reported earnings and tax deductions of business tycoon Giovanni Ravazzotti. The video was posted by @adrian_abcinc on 20 January 2026, where the accountant reacted to figures showing Ravazzotti earning R662 million from just one of his many companies while being taxed at roughly 20%. Using calculations on screen, he broke down combined earnings and deductions, raising concerns about whether the tax paid aligned with South Africa’s tax framework and whether the numbers truly added up.

PAY ATTENTION: Briefly News is now on YouTube! Check out our interviews on Briefly TV Life now!

Giovanni Ravazzotti is widely recognised as the founder and driving force behind Italtile, one of South Africa’s largest tile and bathroom ware businesses. Listed on the Johannesburg Stock Exchange since 1992, Italtile has become a strong indicator of consumer spending in the country. Ravazzotti’s journey is often highlighted as one built on discipline, resilience, and long-term vision rather than privilege. In South Africa, individuals earning high incomes typically fall into a tax bracket that can reach up to 45%, which is why the accountant’s breakdown sparked interest around how company structures, dividends, and salaries are taxed differently.

South Africa’s tax system under scrutiny

The video by user @adrian_abcinc gained traction because it simplified a complex topic many South Africans struggle to understand. With rising living costs and PAYE deductions hitting salaried workers hard every month, the idea of a billionaire paying a significantly lower percentage raised eyebrows. Viewers related to the frustration of seeing large figures discussed while their own pay slips leave little room to breathe, making the content easy to engage with and widely shared.

Mzansi’s response showed a mix of curiosity and concern. Some saw it as a learning moment about tax structures and legal loopholes, while others questioned the fairness of the system. The discussion highlighted a broader tension around wealth, taxation, and transparency in a country where many feel overburdened.

Source: TikTok

What did Mzansi say?

Chrisrarra commented:

“Shares are not cash, thus unrealised gains are not taxable until he sells. If he takes his dividends and buys other shares, tax is deferred.”

PaulMorpheus said:

“So what? He founded the company and took all the risks. He has been in the country for decades, paid billions in taxes, and created thousands of jobs.”

Mark Such wrote:

“All you’re proving is that starting a business is much more lucrative than working for one. However, risk and stability are strong factors to consider.”

GWG commented:

“Pick'n Pay did the same thing. They paid out huge dividends compared to other food retailers; look at them now. Buying back shares is better.”

MoKa said:

“Dividends are derived from profit after tax. SARS has already taken 28%, then another 20% on dividends.”

RobbieP wrote:

“Investment in shares held long term is taxed as capital gains. If traded multiple times throughout the year, buying low and selling high repeatedly, it’s taxed more heavily.”

Timmer commented:

“Other areas, meaning salaries for people who actually work.”

Sindiso Mhlahlo said:

“You can’t compare the investor to the CEO. You should be questioning whether the CEO met KPIs per the performance agreement. Business isn’t emotional, it’s about value and agreed rules set before the game.”

Check out the TikTok video below:

3 Other Briefly News stories about tax

- Actor and presenter Moshe Ndiki has racked up a considerable amount of tax debt, totalling nearly R600,000.

- South African Paralympic star Natalie du Toit is facing legal action from SARS over unpaid taxes exceeding R1 million.

- A major South African radio station is reportedly in the crosshairs of the South African Revenue Service (SARS).

PAY ATTENTION: Follow Briefly News on Twitter and never miss the hottest topics! Find us at @brieflyza!

Source: Briefly News