"From Stipend to Six Figures": Woman's Investment Story on Turning R400 to R400K Inspires Mzansi

- Starting with a small amount is something many people dismiss, but this journey showed how consistency can quietly turn modest beginnings into something life-changing

- The story landed hard because it reflected where many South Africans are right now, wanting to build wealth but feeling blocked by low income and rising costs

- Beyond the numbers, the message spoke to discipline, patience, and learning to play the long game in a country where quick money is often glorified

What started as a few hundred rand slowly became proof that wealth doesn’t always come from big paydays, but from showing up consistently, even when the amount feels too small to matter.

Source: TikTok

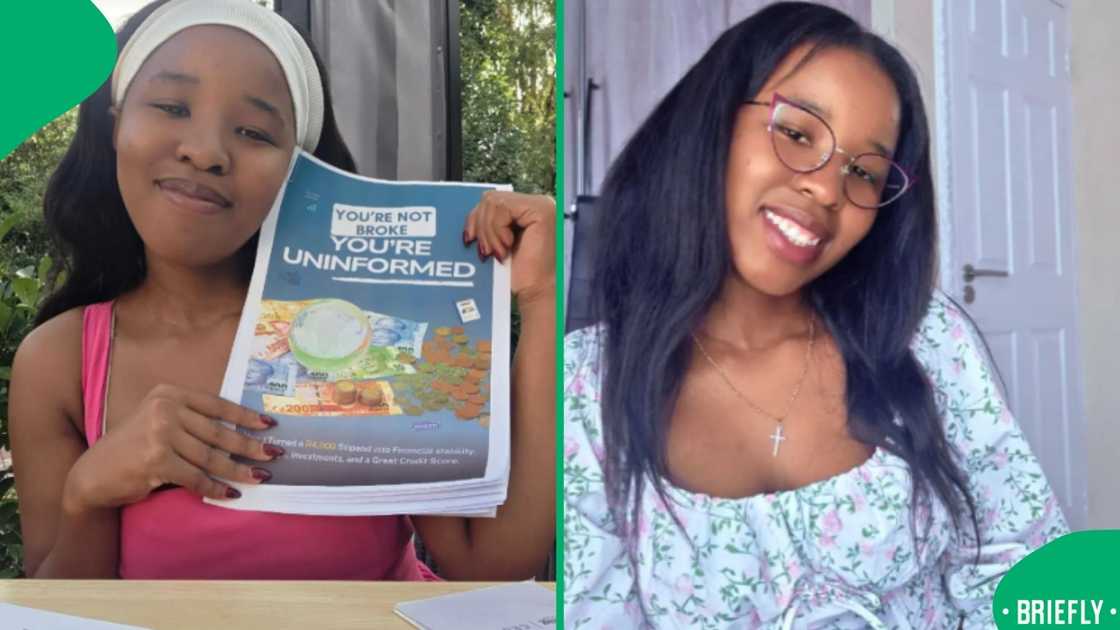

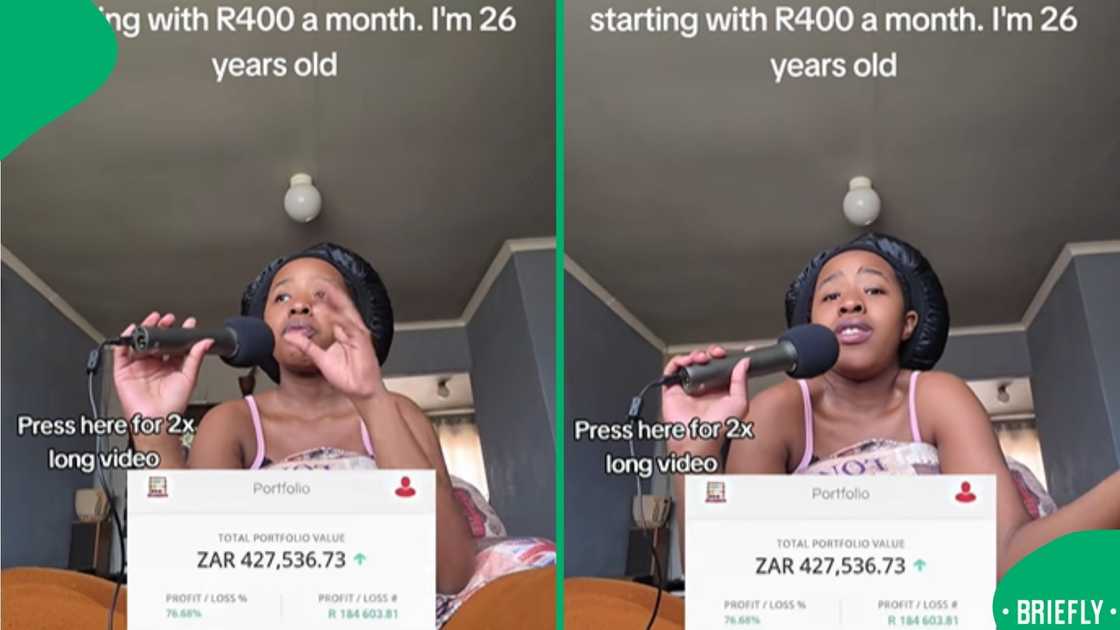

Sakhile Kayla Mahlangu, known online as @sakhile_kayla_mahlangu, posted a video on 30 November 2025 sharing her personal investment journey that began with just R400. In the clip, she showed a screenshot of her Easy Equities account reflecting a portfolio value of R427,536.73. She explained that the money came from a stipend and that her progress was built without financial backing from wealthy parents. Instead, she focused on discipline, consistency, and a long-term plan, documenting how small monthly contributions grew over time.

Her story landed at a time when many South Africans feel locked out of wealth-building due to low incomes and rising costs of living. Investing is often viewed as something reserved for high earners, yet her experience challenged that belief. By highlighting tax-free savings accounts, structured investing, and credit management, the video touched on financial literacy gaps that continue to affect households across the country.

Small investments changing financial futures

User @sakhile_kayla_mahlangu’s video addressed a common fear around money, the belief that small amounts are meaningless. Many viewers saw themselves in her starting point, especially those relying on stipends or entry-level salaries. The transparency of showing real figures helped demystify investing and made long-term financial planning feel more accessible.

DON'T MISS IT: Stay Away From Fake News With Our Short, Free Fact-Checking Course. Join And Get Certified!

Reactions ranged from motivation to curiosity, with many people reassessing how they approach saving and spending. Some felt encouraged to start small, while others appreciated the reminder that consistency often outweighs income size when it comes to building wealth.

Source: TikTok

Here’s what Mzansi said

The African Dream said:

“I've built a portfolio from the first 3 years I moved it from 40K to 230K.”

Omphyy said:

“I’m 18! Opened my EasyEquities account 3 days after my birthday! 😭 And I got a job this holiday just so I can put money into it. 🙏🏻”

Chantie J said:

“I don't know how this app works. I invested in a few companies, but I cannot see it on my portfolio. It's so complicated.”

Carl Richards Sambo Senior said:

“Why aren’t people asking which companies you’re investing in? And when did you invest them, or which ones are you looking to invest in next? So they can do so early rather than later…”

Phoenix asked:

“400128=38400, so where does the 200k come from?”

Vee said:

“Do you lose money though? Or do you just keep gaining money?”

lolodemodel said:

“So, since 2018, you haven’t taken anything from that money? 😭 Once I see some money there, I remove it. 😭”

Snejobe asked:

“When you do your yearly tax returns, do you manually declare anything to SARS that you have investment on EE, or is it already done for us automatically?”

Check out the TikTok video below:

3 Other Briefly News stories about investments

- Veteran actress Connie Ferguson unintentionally became the centrepiece of a rising trend in digital fraud, as scammers increasingly use her likeness to lure people into fraudulent investment schemes.

- Zee Nxumalo previously asked her fans to donate a quarter of a million Rands to fund the music video for her new single Mamma as an investment.

- Miss South Africa 2025 Qhawe Mazaleni's win came with a fair share of controversies, and a new video about investments left tongues wagging.

PAY ATTENTION: Follow Briefly News on Twitter and never miss the hottest topics! Find us at @brieflyza!

Proofreading by Kelly Lippke, copy editor at Briefly.co.za.

Source: Briefly News