eFiling register: How to register for eFiling

Filing for tax and other related services has got no better until the eFiling process was introduced. With this electronic method, registrations, submission of returns, and making payments for tax practitioners, taxpayers and businesses have become so easy and stressless. But then, what steps do you need to take to become an eFiling registered candidate or for your company to become registered? The steps involved in your SARS eFiling registration are discussed in this article.

Source: UGC

Sarsefiling is an online process that makes it easy for tax practitioners, taxpayers and businesses to submit their returns and declarations as well as other related services through the SARS online platform. eFiling registered users are referred to as eFilers, and so, once such's registration is approved, payments and other related activities become easy without needing to wait in queues or worry about office hours.

SARS eFiling registered services

eFiling encourages the declaration and electronic payments of duties, taxes, contributions and levies with convenience and comfort from anywhere. Anyone who is a registered taxpayer has the privilege of signing up for the SARS eFiling service. With this opportunity, such a person would be able to file a return and also pay for SARS as well as request a tax clearance certificate among other benefits through the electronic platform.

READ ALSO: How to register a company online in South Africa

When you register for SARS eFiling, there are three kinds of statuses that your account may state. It could be "awaiting supporting documents", "registration rejected" or "registration successful". While the status of your registration would be communicated to you via your email, in case your registration is not successful, it means you will not be able to use eFiling. But then, that does not mean you should be worried; from the correspondence that you will receive, you would be told what steps to take next.

Source: UGC

What do I need to register for SARS eFiling?

Having understood that becoming an e Filing registered candidate is inevitable, especially if you earn more than the specified amount of money determined on a yearly basis, the necessary documents that you need to register eFiling should be your next concern. Therefore, as stipulated on the official website of the South African Revenue Service (SARS), the following are the documents that you would need:

1. Proof of identity

When registering, you need to provide certified copies of your valid identity document which includes the smart ID card and the green barcoded book. If you have a temporary identity document, passport, driving licence, or asylum seekers permit or certificate alongside the original identification, you can use that. However, if you are a minor, you will need a certified copy of your birth certificate alongside a copy of the identity document of your parent or guardian.

Nevertheless, should your parents be dead, the appointed guardian needs to provide the death certificate. Besides, note that as a taxpayer, you can also supply the uncertified copies of your identity document.

READ ALSO: How to register an NGO in South Africa in 2019?

2. Proof of address

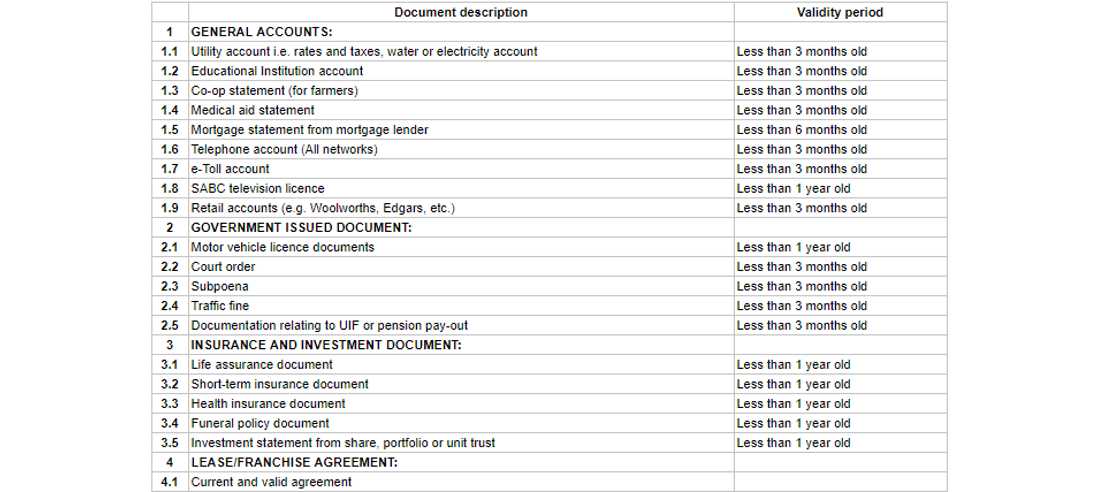

Whatever document that you are submitting as your proof of business or residential address, according to SARS, must clearly show your name as the taxpayer and the physical address. With that understanding, the table below shows a list of documents that will be tenable to SARS:

Source: UGC

3. Proof of bank details

The last document that you need to present is that which shows your bank details. Whatever original letter you are presenting from your bank is not expected to be more than 30 days old. Also, it must confirm your legal name, account type and number, branch code as well as the date that the account was opened. If you are using your original bank statement, ABSA eStamped statement, or the one you generated from the ATM or internet, it must not be more than three months old.

How do I register for SARS first time?

As a first time person, the process involved with how to register for eFiling is not challenging. But then, you should bear in mind that whatever e filing registration process that you are going to embark on, it is expected to take place within 60 days that you receive your first income. More so, depending on your needs, you have the opportunity to register for eFiling as a tax practitioner, an individual taxpayer, or as an organisation.

Once you have your documents on the ground, the following are the next steps to take:

- Visit the official website of SARS.

- Click on "Register", and from there, you would be redirected to a new page;

- On the landing page, there are three options available, and so, you would be required to choose the one that applies to you.

- After clicking on the appropriate option, another page would open and there, you will need to read through the terms and conditions and accept before moving on to the next step.

- Once you click on "I accept", the next thing to do is to create your user ID that you will use to log in to the SARS eFiling official website each time you have something to do there. Note that as part of protecting your account, SARS will add up four characters to your user ID while you will need to provide a password of your choice. You will also provide your identification number as well as your cell phone number before clicking on "Register".

- Then, a SARS eFiling registration form will open up wherein you will need to input your personal information to authenticate your claim.

- More so, you would be required to provide the details of your organisation if you are a representative of one and if your employment is full-time/part-time, your employer's details would be required.

- Once you complete that, you will have to select the tax types that relate to you which you want to register for. This means that your tax reference numbers must be available while registering.

Note that once you complete your registration process, SARS needs to authenticate your profile, and that means you may have to wait for about 48 hours. If your registration is declined or you have any other enquiries to make, you can call the SARS eFiling helpline on 0800 00 7277.

As explained above, it is clear that there are so many benefits attached to eFiling. Not only does this service allows you to file your tax and carry out related services, but you can also do that at the comfort of your home or office. More so, you can track the state of your report any time of the day because of the 24 hours access to their portal. So, as an eFiling registered user or better put, as an eFiler, all of these are some of the benefits that you enjoy.

READ ALSO: What is Memorandum of Incorporation 2019?

Source: Briefly News