Capitec branch code & SWIFT code: Updated 2024 guide

Capitec is one of South Africa's most trusted and well-loved banks thanks to its affordable banking rates, helpful employees, and easy-to-use banking app. Knowing the Capitec branch code in South Africa is useful if you are an existing customer. What are the relevant banking codes?

Source: Getty Images

TABLE OF CONTENTS

- What is the Capitec branch code?

- How do you check your branch code?

- Capitec universal branch code in South Africa

- Frequently asked questions

- Can international payments be made to my bank account?

- Does Capitec offer foreign exchange services?

- Can you open an account if you are not from South Africa?

- What type of identification can open an account on your phone?

- How can you order a debit card?

- How can you activate your debit card?

- How much will it cost to get your debit card delivered?

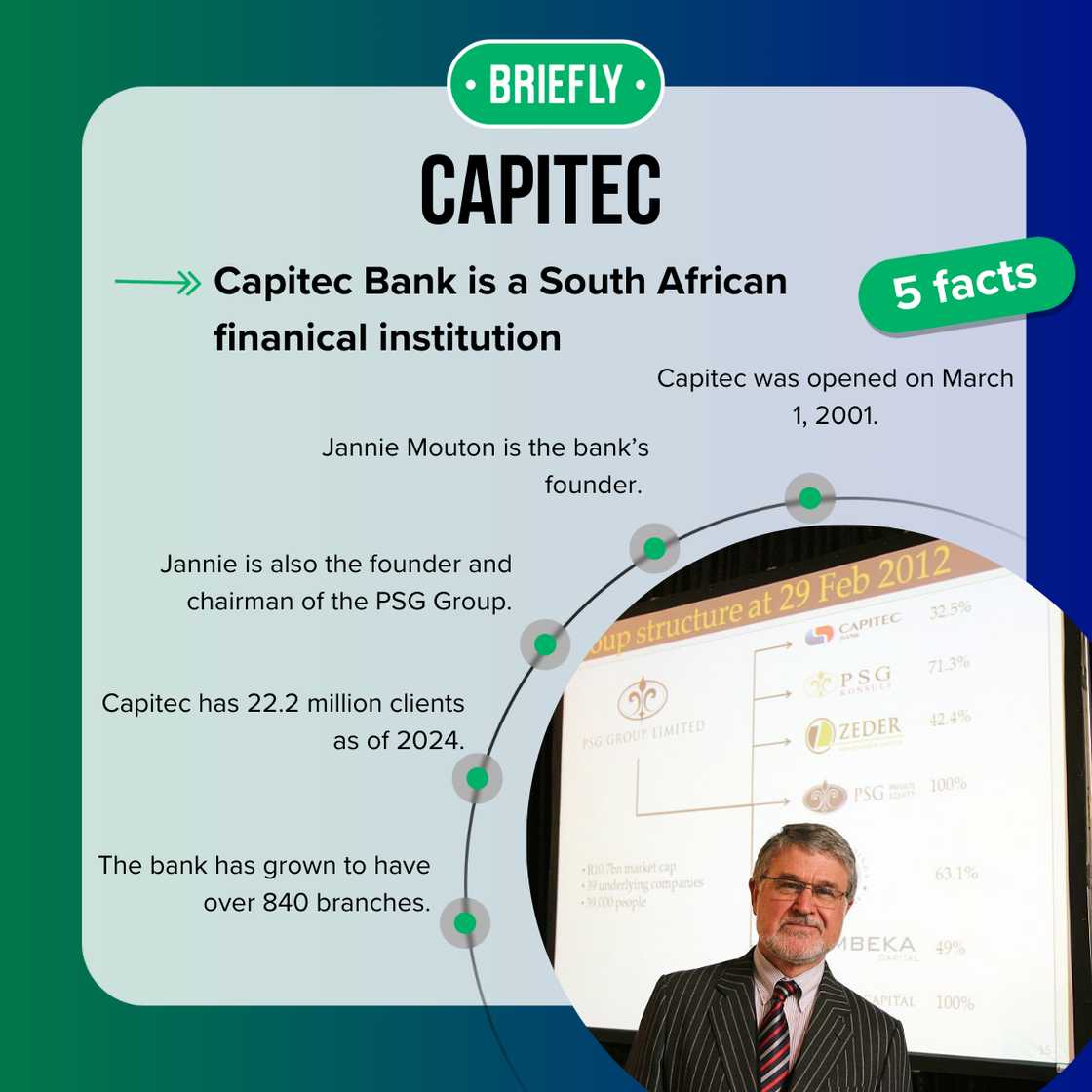

Capitec was established on March 1, 2001, and has grown from 55 branches and 25,000 customers to over 840 branches nationwide and 15 million satisfied customers. Based on customer volume, the bank is now considered the largest retail bank in the country.

The bank also sees a monthly increase of 180,000 new app clients, highlighting its popularity among South Africans. Capitec mentions on its website that it focuses on accessibility, simplicity, affordability, and personalised services, which keeps an influx of customers in.

What is the Capitec branch code?

A branch code is used when depositing money into someone's bank account. It serves as a unique identifier for each bank branch. The Capitec bank branch code is 470010, a Capitec universal branch code.

Which branch of Capitec is 470010?

The 470010 branch code can be used for all branches. However, the Capitec branch name would be the bank name and the area or mall in which it is located.

What is the branch code 250655?

The branch code 250655 is for First National Bank (FNB), the FNB universal bank code. FNB's SWIFT code for international transfers is FIRNZAJJ.

Source: Original

Which branch is 051001?

Standard Bank's branch code is 051001, which is a universal code. Its SWIFT code is SBZAZAJJ, which is used for international transfers for Standard Bank's online transfers.

How do you check your branch code?

You can find your bank's universal branch code in various ways, including:

- Checking your bank statement: Your bank statement shows your branch code in your bank's details.

- Visiting your bank's website or app: Navigating the financial institution's website or banking app will provide you with the relevant branch code.

- Going to your local bank branch: You can visit your local bank directly, where a consultant will give you the branch code.

What is the international code for Capitec Bank?

A SWIFT or BIC code is an eight- to 11-character code that identifies your country, city, bank, and branch. The Capitec SWIFT code is CABLZAJJ, and the bank mentions that it must be used in the ld 57A of the SWIFT payment instruction, as it automates the payment's processing, or the payment will be returned to the sending bank.

Capitec universal branch code in South Africa

The Capitec branch code in Gauteng is the same as the national Capitec branch code, as it is considered the universal branch code. Here are the universal details for the bank:

Bank name | Capitec Bank Limited |

Bank branch | Capitec Bank CPC |

Branch code | 470010 |

BIC code (SWIFT) | CABLZAJJ |

Bank branch address | 10 Quantum Street, Technopark, Stellenbosch |

Province | Western Cape |

Phone | 021 809 5981/82/80 |

Fax | 021 880 1845 |

Frequently asked questions

Now that you know the relevant bank branch code details, what else do you need to understand as a Capitec customer? According to their website, here are their most commonly asked questions.

Can international payments be made to my bank account?

Capitec accepts international payments at competitive currency conversion rates. They suggest that customers receive inward payments in foreign currency as they will get more Rands in their account, obtain their money faster, and have more competitive rates.

Source: Getty Images

Does Capitec offer foreign exchange services?

The bank offers varying services to individual clients (business clients are omitted):

- Issuing debit cards that may be used out of South Africa.

- Assisting clients in receiving money into their accounts from abroad.

- Opening accounts for foreign nationals who are working on contracts in South Africa.

Can you open an account if you are not from South Africa?

You can open an account if you are not a born South African resident under the following conditions:

- You possess a permanent residence permit and are employed (with evidence).

- You possess a temporary residence and work permit and are employed (with evidence).

What type of identification can open an account on your phone?

You can open a bank account from anywhere within a few moments. You must provide your South African ID number, an up-to-date South African cell phone number and email address, and a smartphone that can take photos to confirm your identity.

How can you order a debit card?

Only clients who have opened their first account with the bank may have their debit card delivered. If you have opened an account on the app and chose not to have it delivered but changed your mind, here is how to do so:

- Sign into your account on the Capitec app.

- Select the 'cards' option.

- Choose 'order card' and follow the simple on-screen instructions.

How can you activate your debit card?

You can activate your debit card once it has been delivered. Sign into the app as you would when ordering your card and choose the 'card's option. Select 'activate card' and follow the instructions.

How much will it cost to get your debit card delivered?

Your card will be delivered to your door directly. There is no charge for delivery.

Knowing where to find your bank's relevant codes helps you transfer and receive money faster. If you have any further questions not highlighted, you can visit a Capitec branch near you for further assistance.

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

READ ALSO: CTC salary: Cost to company, NETT & gross packages explained

Every individual's income is subject to varying expenses in your offer, usually your CTC salary. Briefly.co.za wrote an article about a potential employer's cost to the company varies, and other details.

What does your CTC salary entail? This article discusses everything you need to know about your CTC, NETT, and gross pay, including definitions and examples.

Source: Briefly News