How to check my credit score in South Africa (2024)

An individual's creditworthiness, calculated based on their credit history, is considered before they can access funds. The higher the score, the better their chance of getting funds. Lenders use these scores to determine whether to approve an individual's funds application and what interest rate and limit to offer. But what must I do how to check my credit score in South Africa? You may ask.

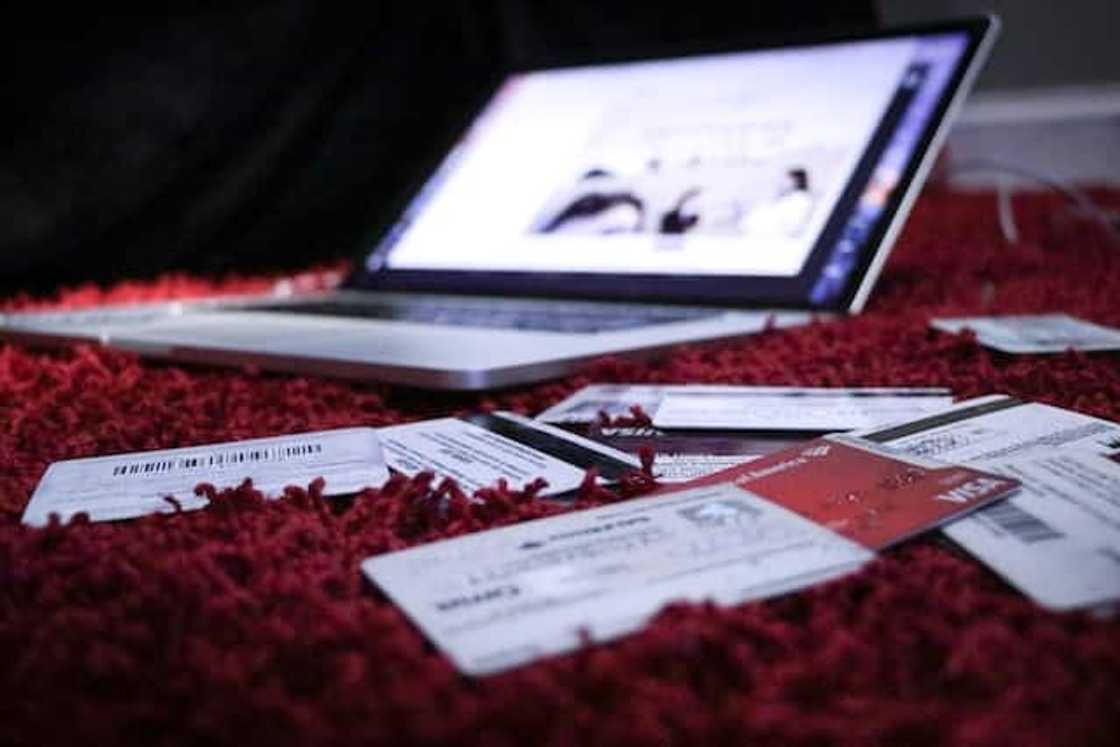

Source: UGC

Maintaining a good credit score is essential for accessing funds in South Africa. It can also positively impact other areas of an individual's financial life, such as insurance premiums and rental applications. A credit score check in South Africa is crucial as it helps individuals monitor their payment history and scores to ensure accurate information and identify potential fraud or errors.

What is a credit score in South Africa?

It is a three-digit numerical representation of an individual's creditworthiness. The number ranges from 0 to 999 and is calculated based on various factors. Some include payment history, credit utilisation, length of credit history, and types of credit accounts.

You must make all your funds payments on time to maintain a good score. At the same time, you must keep your credit utilisation ratio low, meaning you should use only a little of your available credit. Then, it would be best to minimise your number of applications.

Besides accessing credit at more favourable terms, a good credit score can make qualifying for other financial products easier, such as mortgages and car loans.

What is a good credit score in South Africa?

Financial institutions like banks consider a good credit score in South Africa from 610 or higher, and anything above 661 is considered a decent score. Nonetheless, different lenders and finance companies have their criteria.

Meanwhile, according to TransUnion, one of the primary data collection agencies, the average credit score in South Africa is between 583 and 613.

Specifically, according to the bureau, the credit score ratings in South Africa are generally as follows:

- Excellent: 767 to 999;

- Very good: 681 to 766;

- Good: 614 to 680;

- Average: 583 to 613;

- Below average: 527 to 582;

- Poor: 487 to 526;

- Very poor: 0 to 486.

Source: UGC

How can I check my credit score in South Africa?

You can check your accounts and payments history and score through any major data collection agency in the country. Some of them are TransUnion, Experian, and XDS. Here are the steps to follow:

- Visit the website of your preferred data collection agency;

- Navigate to the website section that allows you to request accounts and payments history or score;

- Follow the instructions on the website to enter your personal information and verify your identity. You may need to provide your ID number, proof of address, and other personal details;

- Once you have verified your identity, you can access your accounts and payments history;

- Review the displayed report to ensure all the information is accurate and up-to-date. If you identify any errors or inaccuracies, you can dispute them with the agency you have chosen.

How can I check my credit score completely free?

You can get a free credit report per year from the major agencies. But then, if you need additional reports, you may obtain them for a fee.

How can I check my credit score by myself?

The data collection agency you choose will determine how to check the score without anyone else's assistance. For instance, Experian provides free credit reports and scores on My Credit Check and My Credit Expert.

On the other hand, TransUnion allows you to do so using a USSD code. All you need to do is dial *120*8801# using the number linked to your profile. But remember that you have to verify your identity by entering your ID number.

Source: UGC

How do I check if I'm blacklisted?

When an individual is blacklisted, they have a bad accounts and payments history, or finance companies consider them high risk. Follow the steps below to see if there are any harmful listings or judgments against you:

- Contact any of the major data collection agencies in South Africa of your choice;

- Request a copy of your accounts and payments history and score;

- Review your report for harmful listings or judgments against you, including unpaid debts, defaults, or court judgments;

- If you identify any, contact the finance company or lender associated with the listing to see if you can resolve the issue and remove the listing.

Note that being blacklisted does not necessarily mean you cannot access funds. The only thing is that having a poor accounts and payments history or negative listings can make it more challenging for you to obtain funds at favourable terms.

A good accounts and payments history and score before applying for funds are compulsory. But then, out of curiosity, some borrowers have been stuck, so hearing statements like, "I do not know how to check my credit score in South Africa" have almost become a norm. The steps discussed so far are easy to follow.

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

READ ALSO: How to get your SASSA OTP code

Briefly.co.za shared important details on getting your SASSA OTP. The South African Social Security Agency's OTP is essential to completing your application form for the SRD grant.

This code is digitally generated for everybody applying to verify the ownership of the SASSA accounts. Good enough, there are two options through which you can get the OTP: through WhatsApp and the SRD website.

Source: Briefly News