“Check Your Tax Code”: Woman Shows Her Pay After Deductions, Calculations Confuse Netizens

- A young woman took to TikTok to give app users a look at her payslip and showed her tax deductions

- From what the woman's post shows, she gets paid roughly R25,000 after all the deductions

- People in the comment section could not believe what they had seen and asked the woman to check her tax code

- A local chartered accountant based in the United Kingdom spoke to Briefly News about the country's taxing system

PAY ATTENTION: Let yourself be inspired by real people who go beyond the ordinary! Subscribe and watch our new shows on Briefly TV Life now!

Source: Instagram

After a young woman shared a glimpse of her tax deductions, people on the internet were left scratching their heads in confusion.

Taking to TikTok, a British nurse named Debs, who uses the handle @nursedebss on the popular app, shared a screenshot of the money she received after her deductions.

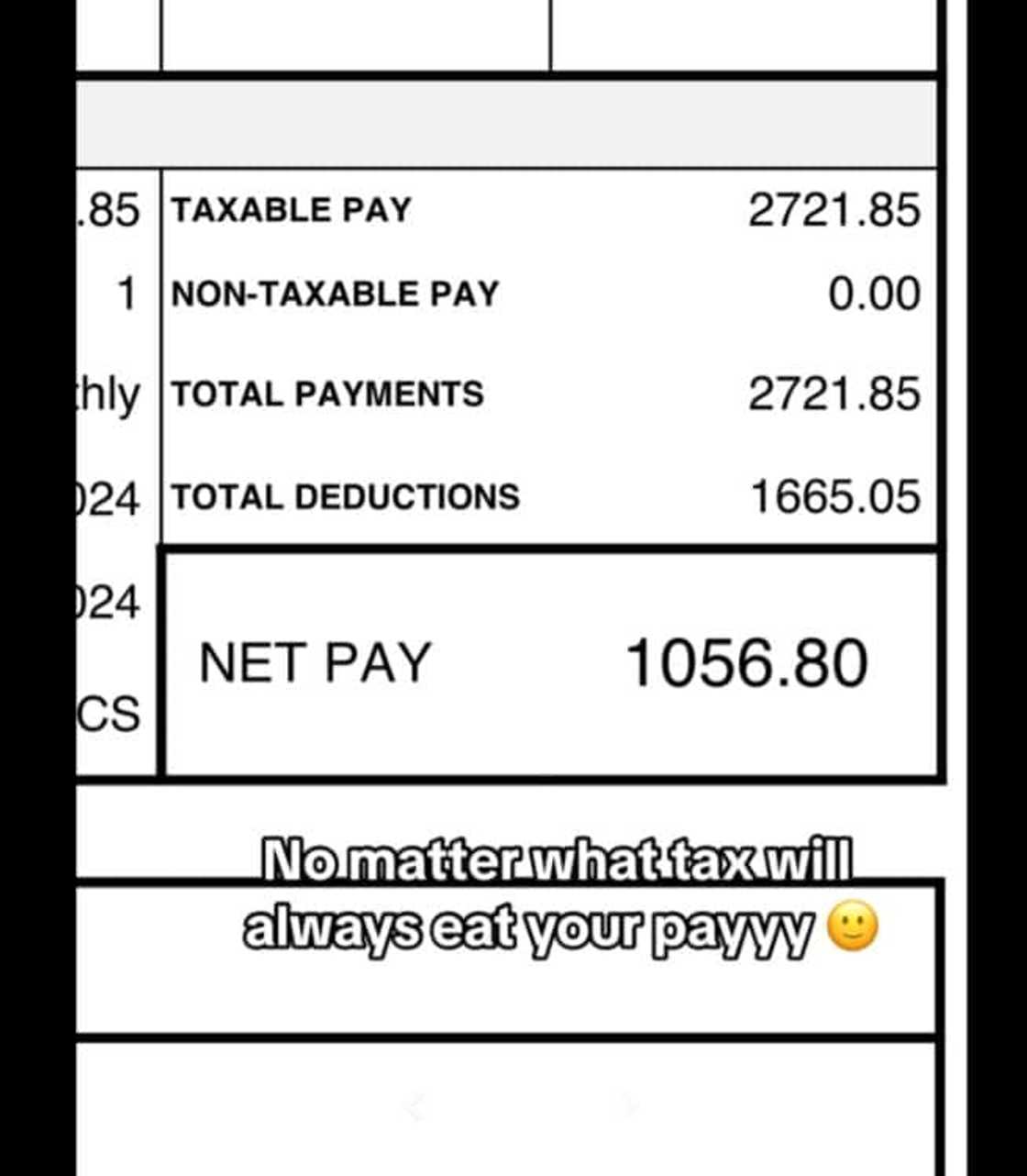

According to the payslip, the woman's taxable pay was £2721.85 (approximately R65,000), while her total deductions came to £1665.05 (roughly R40,000). These possible deductions left her a net income of £1056.80 (roughly R25,000).

Saddened by the financial outcome, the young nurse wrote in her video:

PAY ATTENTION: stay informed and follow us on Google News!

"Maturing is realising no matter what, tax will always eat your pay."

Debs also added in her caption that after seeing her payslip, she never "felt so much heartbreak."

Take a look at Debs's post below:

Source: TikTok

Netizens left wondering

Debs's TikTok post received over half a million views, and thousands of app users flocked to her comment section, flabbergasted.

@dndtay was confused and said:

"The tax code has to be wrong. This cannot be right, surely."

@anon3003 shared their shock:

"HUH?! I get way more than that after tax and pension contributions, and I get paid a bit less than you monthly. So, how is this possible?"

@kiera_marie01, who also works in the healthcare industry in the United Kingdom, shared:

"As a National Health Service worker, this is what I get taxed every month, and they’ve double and triple-checked it. It’s right, man."

Chartered accountant provides much-needed clarity

Rasheedah Parker CA(SA) explained to Briefly News that in the UK, a person is normally taxed on an income of over £12,501 and up to £50,000. Less than the first amount is not taxed while more than £50,000 is taxed at 40%.

When asked about her take on the woman's payslip, Rasheedah said:

"The deductions on the woman's payslip definitely seem excessive and not what you'd usually expect to see, especially since her net pay is less than 40% of her taxable pay. However, deductions can include more than just tax. It can include National Insurance, pension, medical insurance, life insurance and more.

"There's not enough information from this slip to fully understand what makes up her taxable pay and her deductions."

Rasheedah also explained the meaning of a "tax code" netizens told the woman to check. She says:

"In the UK, your tax code consists of letters and numbers, for example, 1257L. The numbers part tells the employer how much can be earned without paying tax (i.e. your personal allowance, in this case, £12,500). The letters in your tax code reveal how your specific circumstances affect your personal allowance."

She continues:

"The comments suggest that the tax code used for this lady is incorrect, resulting in more tax being deducted from her pay than should be."

Employer leaves worker with less than R100 after deductions

In a related article published early this month, Briefly News reported about a legal practitioner who narrated the plight of a lady whose employer deducted N53,000 (R654.60) from her salary and paid her a balance of less than R100.

The man identified on X as @egi_nupe__ said that that amount was deducted from her salary because a customer’s money was reversed.

PAY ATTENTION: Сheck out news that is picked exactly for YOU - click on “Recommended for you” and enjoy!

Source: Briefly News