Tyme Bank Universal branch code and swift code for money transfers 2022

TymeBank stands for Take Your Money Everywhere, and it is a banking service that is fully digital with tills across South Africa for when you need to withdraw cash. This initiative was developed as part of a Deloitte consulting project funded by the telecommunications provider MTN group. Tyme is easily accessible, affordable, and also very client friendly. So, what is the TymeBank Universal branch code? How can I send money using their services? Read on!

New feature: Check out news exactly for YOU ➡️ find “Recommended for you” block and enjoy!

Source: Instagram

TymeBank became a stand-alone business in June 2012, and currently, the majority shareholder of the company is African Rainbow Capital Financial Services Holdings.

What bank does TymeBank fall under?

South Africa's first black-owned bank mainly focused on retail and business banking. The majority stakeholder for TymeBank is African Rainbow Capital Financial Services Holdings.

Unlike other banks, TymeBank does not have any physical locations. Instead, they operate on an online app exclusively, permission they received from the South African Reserve Bank in 2017.

TymeBank falls under a category of banking called Online banking. Users who opt to join TymeBank can conduct financial transactions via the Internet.

What is a TymeBank branch code?

The TymeBank branch code comes in handy when someone wants to send the user money via an Electronic Fund Transfer (EFT). The user will need to send the person sending the money their account number - found on the debit card and the TymeBank branch code - 678910.

TymeBank SWIFT codes

The SWIFT code for TymeBank is CBZAZAJJ. These codes are unique bank identifiers used when a client transfers money between banks, especially for international money transfers or SEPA payments.

TymeBank branch name

What is the branch name for TymeBank? Since its services are fully digital, its name serves as its branch name. Details needed when making an international payment typically require the SWIFT code, branch name, code, address etc. Find a summary of these details below;

SWIFT CODE | CBZAZAJJ |

Branch Name | TYMEBANK |

Branch Address | 30 Jellicoe Avenue |

Branch Code | 678910 |

Bank Name | TYMEBANK |

City | Johannesburg |

Country | South Africa |

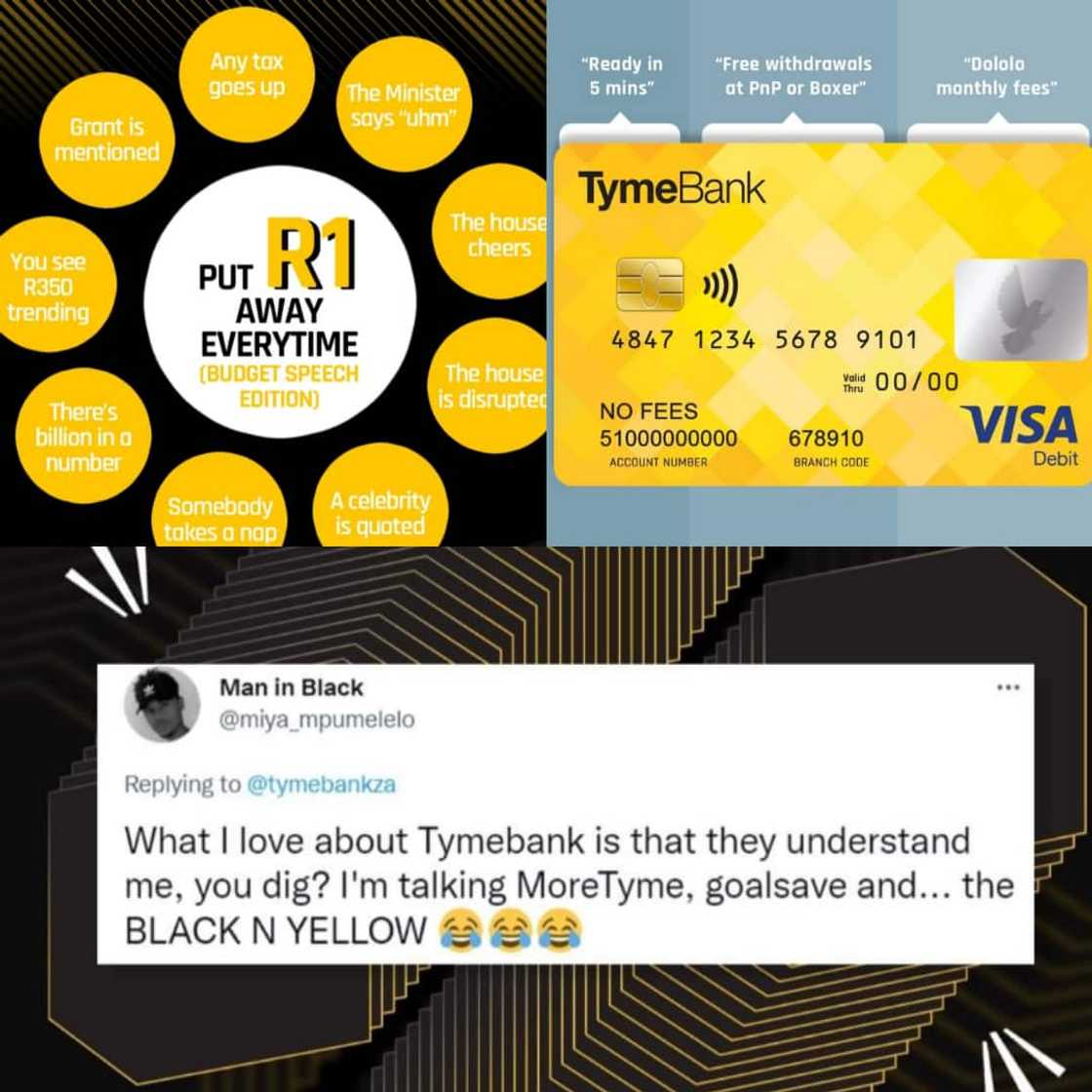

Source: Instagram

TymeBank's SendMoney

To use TymeBank's SendMoney, you need to have an EveryDay account. This account allows the user to send money to any person with a working South African cellphone number. The one who has received the money can then;

- Withdraw from any Pick n Pay or Boxer till point (for just R3)

- If they also have an EveryDay account, they can withdraw from an ATM for R10 per R1000

Did you know sending money from TymeBank to another account holder is free? On the other hand, sending from your EveryDay account to another account costs only R7 per transaction. This means that if you send R500, the recipient will get R493 due to the R7 fee. You can alternatively add R7 to the total amount being sent so that the total amount is not deducted.

What is the TymeBank send money code?

First, dial *120*543# and then follow the on-screen instructions. You will be asked to confirm the receiver's details, including their cellphone number and amount of money. You can click 0 to go back to the main menu if the details are inaccurate. If not, you click send and receive a confirmation message.

What is a universal branch code?

As the name suggests, a universal branch code is a code that can be used across all a bank's branches. You can use the code for every transaction, and it represents all the branches of a bank.

When should you use a universal branch code?

This code can be used when someone makes an online electronic funds transfer (EFT) payment. For EFTs, you will need a branch code and a TymeBank account number.

Using a universal branch code is ideal for those who wish to use internet banking. Also, while transferring money to another account, the online banking system will request a branch code for confirmation and speedy processing.

Source: Instagram

Can TymeBank receive international transfers?

Users can receive international payments into their accounts. The payments can come through FNB, ABSA, Standard, or Nedbank and are converted into South African Rands at the sender's exchange rates.

This service is a great idea for young people and anyone who wishes to be unbanked. The TymeBank universal branch code, account number and details are easy to use and make banking a seamless experience.

READ ALSO: Banks in South Africa: List of non-commercial and commercial banks in South Africa

Briefly.co.za recently published an article about banks in South Africa. Did you know that according to the South African Reserve bank data in the 2017 financial year, the total banking assets in the country were ZAR 6 trillion?

Well, that is how successful Commercial banks in South Africa have been. The assets growth in this industry has been steady since 2002; the figure was $88.7 billion. The question is, which banks in South Africa have contributed to the figure? Get the story!

New feature: check out news exactly for YOU ➡️ find "Recommended for you" block and enjoy!

Source: Briefly News