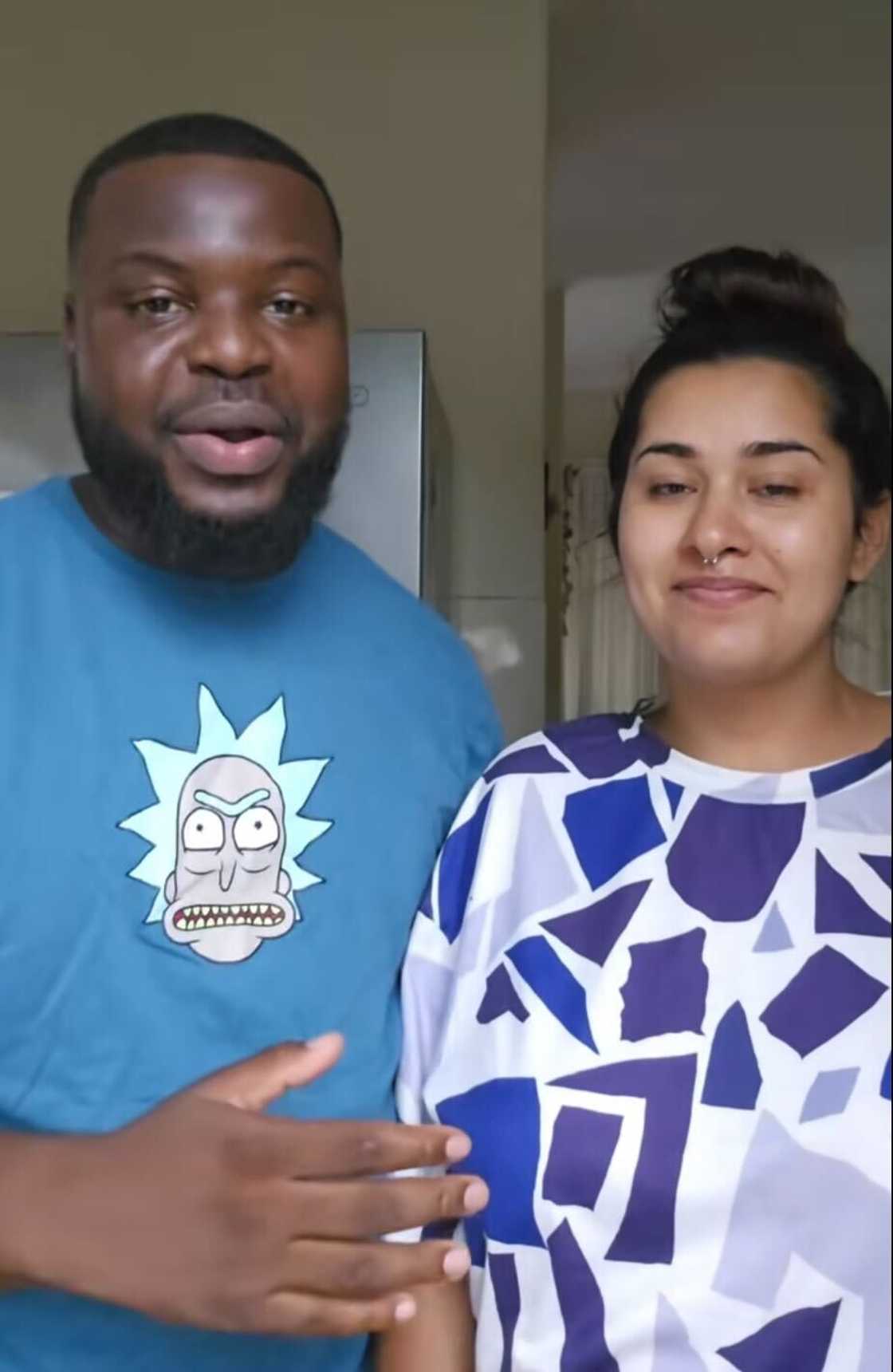

South African Couple Shares How They Survived on R4.5k a Month: “It Was All Jesus”

- A couple shared with their viewers how they managed to live on R4.5k a month, which amazed many people online

- They also revealed some tips and tricks on how they survived to make ends meet in the TikTok video

- Social media users reacted as they flooded the comments section expressing their thoughts

- Briefly News caught up with financial expert Fulufhelani Mashapha to discuss why financial planning is key for couples' long-term stability

Don't miss out! Join Briefly News Sports channel on WhatsApp now!

In a time when the cost of living continues to skyrocket, one couple in Mzansi has turned heads by revealing how they manage to survive on a modest R4,500 per month and still make ends meet.

Source: TikTok

Couple share how they survived on R4.5k a month

The love birds took to social media to open up about their financial struggles during a difficult season when the gent was earning R4,500 monthly. In the clip shared under the handle @daniel_chitombi, the guy shared how once they got together he was not earning much but they thanked God that they made it through and never slept hungry.

Read also

"Why would you sign?" Emotional woman shows awful conditions of R4,5k rental home, SA asks questions

He revealed that they were sharing a house with a friend and their rent was R5,000 and when he got paid, he would put in for rent R2.5k. As for groceries, he used PayJustNow, to buy one of the Game stores.

PAY ATTENTION: Briefly News is now on YouTube! Check out our interviews on Briefly TV Life now!

PayJustNow is a credit facility that allows users to buy now and pay later in three interest-free instalments. When making a purchase online or in-store, you pay one-third of the total upfront. The remaining balance is split into two equal payments, automatically deducted over the next two months. As long as payments are made on time, there are no interest charges or hidden fees. This makes it a budget-friendly option for shoppers looking to manage their expenses more easily.

The man emphasised there was no interest charged, on the R3,000 groceries, which was the credit limit that they had on the card.

"We only pay a R1,000 because we needed to pay for three months," the man shared.

The supplies also included toiletries, and they did all the shopping at the Game store. They explained that they would spend R500 on electricity, while the other R500 would go towards buying meat, bread, or covering transport costs for the man to get to work on rainy days. He added that he usually walked to work because it wasn’t too far from his home.

Read also

"It's a lie”: Mzansi in disbelief as lady shows what R200 grocery haul looks like in South Africa

"But then guys, through it all it was all Jesus! We loved each other so we had each other through it even though I was earning basically nothing. But then Jesus, guys, there's some days we never had anything and we did not ask, we never asked anyone for anything, we just prayed. There is a time one of our friends just rocked up with food and we did not even ask and it lasted us a week as we did not have food," they both explained in the clip.

Watch the video below:

Briefly News spoke with financial expert Fulufhelani Mashapha on why financial planning is crucial for a couple’s long-term stability. She explained:

"Financial planning helps couples clearly define their financial goals, both short-term and long-term. Working towards these goals can help the couple achieve financial stability in the long run.

Additionally, financial planning ensures that couples are adequately insured against the risks they face and enables them to leave an inheritance for their children or family. Financial planning sessions also provide an opportunity to learn about finances, identify gaps, and make plans to ensure financial security."

Mzansi reacts to couple's story

With many people facing similar economic challenges in South Africa, the video sparked a buzz about budgeting, financial literacy, and survival amid the rising cost of living as many shared their own experiences.

Rayven shared:

"I lived on R3,200 pm with a wife and 2 kids. God never let me down."

Mad Max wrote:

"Bro, I was earning R2,000 pm, and by God's grace and mercy, we never went to bed hungry."

Thembashilobane added:

"So you didn't go on dates and she still stayed, she's loyal boss, she's a keeper. no money for nail, hair salon and shopping malls, you better marry that girl."

User expressed:

"Bro, people earn over 20k, but struggle to make ends meet. Can't even afford to buy food."

The Queen was touched by the couple's story:

"I love this testimony."

Source: TikTok

Other articles sharing budgeting tips

- Briefly News previously reported that a South African woman took the initiative to share a budget for an unemployed mother, and the online community was amazed.

- The momma bear @lifewithntosh revealed the expenses of a 10-day adventure in a TikTok video.

- With a family of eight to feed, a lady has mastered the art of budgeting and stretching her grocery budget.

Source: Briefly News

Johana Mukandila (Human Interest Editor) Johana Tshidibi Mukandila has been a Human Interest Reporter at Briefly News since 2023. She has over four years of experience as a multimedia journalist. Johana holds a national diploma in journalism from the Cape Peninsula University Of Technology (2023). She has worked at the United Nations High Commissioner for Refugees, PAICTA, BONA Magazine and Albella Music Production. She is currently furthering her education in journalism at the CPUT. She has passed a set of trainings from Google News Initiative. Reach her at johana.mukandila@briefly.co.za

Fulufhelani Mashapha (Author and Actuarial Analyst) Fulufhelani Mashapha is a qualified actuarial analyst and author of 'Mind Your Cents'. She is also a One Young World Ambassador and Personal Finance Youtuber focusing on budgets, debt, savings, insurance and investments.