Mzansi Woman Finds Out She Owes SARS R60k, Raises Awareness for Provisional Taxpayers on TikTok

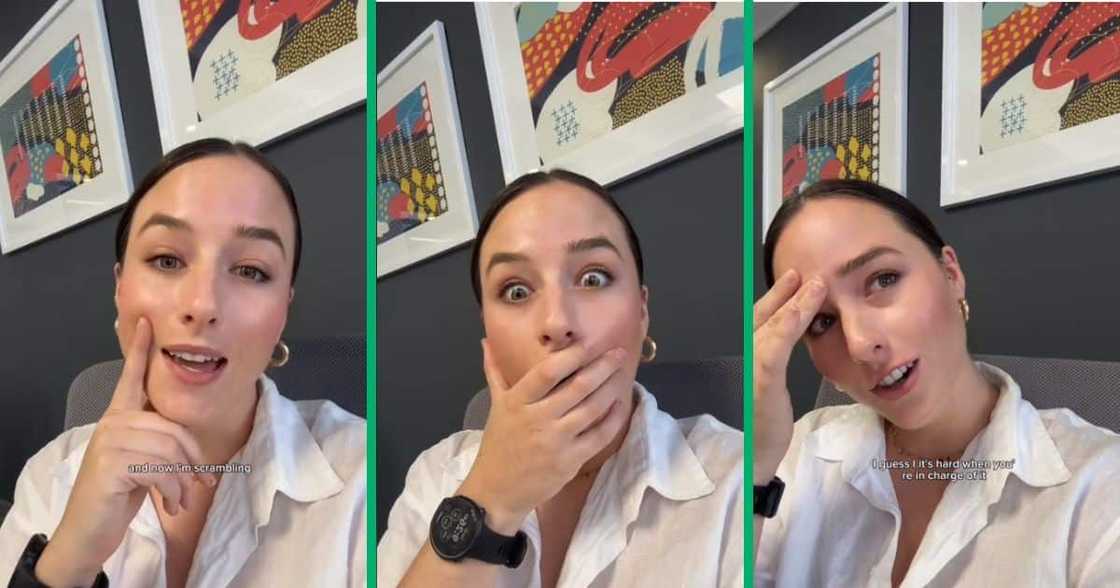

- A South African woman named Samleigh Ritchie shared a video on social media expressing her stress about discovering a R60 000 tax bill from SARS

- She explained she was a provisional taxpayer and hadn't saved enough throughout the year

- The video resonated with other viewers who shared their own tax struggles and offered her advice

- A qualified professional Chartered Management Accountant spoke to Briefly News about provisional tax

Source: TikTok

A stressed South African woman took to social media to share how she found out she owed SARS R60 000 worth of tax.

Woman stressed by R60K tax bill

A video shared by @samleighritchie details how her tax broker called her to inform her that she needed to pay R60 00 to SARS by the end of February.

@samleighritchie explained that she was a provisional taxpayer last year, which meant that she was in charge of her taxes and had to make sure she had enough money to pay her taxes at the end of the tax year.

PAY ATTENTION: stay informed and follow us on Google News!

"I've been putting money away every single month but obviously not enough. I have about R25 000 saved but not R60 000.

"To be honest with you, I knew in the back of my mind that I wasn't putting enough money away for tax. It's hard when you're in charge of it," the flustered woman said.

@samleighritchie advised provisional taxpayers to be honest about how much tax they must pay.

Watch the video below:

SA reacts to troubled taxpayer

The video garnered many views and reactions from netizens who responded with their tax-related frustrations and concerns. Others responded with helpful advice for @samleighritchie on how she could try to approach her dilemma.

Landi commented:

"Girl, why so much? Please let them look into it again, there is almost always something else that can be deducted."

sketeles commented:

"Just don't pay."

Gontse___ responded:

"You can pay the R25000 you owe and ask them for a payment arrangement for the balance."

Mooncake replied:

"Dude!!!!! SAME!!!! OMFG. I was like.....why SARS? I'm being evicted soon because my job had to let me go. now you want TAX TOO?????!!!! I CAN'T DEAL."

Andrea Muller commented:

"Lmao you’re so calm as a freelancer I feel your struggles ."

Tatum Amber Bessick replied:

"How do I know how much I'm going to pay omg I'm stressed."

Zee replied:

"I pay tax every month they take it from my salary but I somehow owe them."

Kayleigh Marcus said:

"My dad is an accountant and LOVESSS tax and does lots of people's tax- so I’m so happy I don’t have to do tax✨."

Sarah Koopman replied:

"Provisional tax is adulting at a level that I was NOT prepared for ."

Tax expert weighs in on provisional tax

Qualified Chartered Management Accountant and Chartered Stockbroker Kenneth Thabo Bogatsu, from Bryanston Tax Shop Accountants franchise, shared insight into what provisional taxpayers should do.

Provisional taxpayers can adopt several strategies to save enough money to cover their potential tax obligations or liabilities.

"It is essential for provisional taxpayers to budget and plan for their tax payments. They should estimate their income for the year, calculate their expected tax liability, and set aside funds regularly to cover these obligations.This can be done by budgeting at the start of the year and then continuous reforecast, to adjust for any changes, of expected income at the end of the year they can also have an account for their savings."

He also added that if one just recently became a provisional taxpayer should conduct research.

"New provisional taxpayers should educate themselves about their tax obligations. They can access resources provided by SARS, such as guides, publications, and online tutorials, to understand the requirements for provisional taxpayers and also consult with professionals if need be so they can receive guidance on tax planning, compliance requirements, and strategies for managing tax payments effectively."

South Africa hikes taxes and social spending before vote

In another story, Briefly News reported that South Africa plans to hike taxes and increase spending on social grants ahead of a general election in May amid sluggish growth and high debt, the government said on Wednesday.

The treasury announced increases in income tax and alcohol and cigarette duties as part of a national budget unveiled a day after President Cyril Ramaphosa announced general elections on May 29.

The treasury announced increases in income tax and alcohol and cigarette duties as part of a national budget unveiled a day after President Cyril Ramaphosa announced general elections on May 29.

PAY ATTENTION: Follow Briefly News on Twitter and never miss the hottest topics! Find us at @brieflyza!

Source: Briefly News

Nothando Mthembu (Senior editor) Nothando Mthembu is a senior multimedia journalist and editor. Nothando has over 5 years of work experience and has served several media houses including Caxton Local Newspapers. She has experience writing on human interest, environment, crime and social issues for community newspapers. She holds a Bachelor’s Degree and an Honours Degree in Media Studies from the University of KwaZulu-Natal, obtained in 2016 and 2017. Nothando has also passed a set of trainings by Google News Initiative. Email: nothando.mthembu@briefly.co.za

Kenneth Thabo Bogatsu (Owner of Bryanston Tax Shop Accountants) Kenneth Thabo Bogatsu is a seasoned Chartered Accountant who has been in the industry for 26 years. Their expertise is marked by diverse experiences across seven industries and two resident countries. Bogatsu's expertise encompasses finance, accounting, tax, and operational and strategic management. Their extensive competence spectrum includes project management, communication, budgeting, and board participation.