UIF calculator: Disover how much you can claim from UIF

The Unemployment Insurance Fund (UIF) helps employees financially when circumstances put them out of their jobs. The employer's and employee's contributions go to the insurance scheme, and the employee can claim against the fund for the duration they aren't working. A UIF calculator guide helps you know how much money you can claim depending on your contributions.

Source: UGC

TABLE OF CONTENTS

- UIF calculator: How do you calculate a UIF claim?

- What is the UIF limit?

- How many months do you get paid UIF?

- How long does UIF pay after signing?

- How long does a payout take?

- How long does the UIF second payment take?

- What is the maximum UIF payment?

- What can you do if your UIF payout takes too long?

- Were the UIF contributions increased?

- Who can be exempted from UIF payments?

- What are the best online UIF calculators?

Many use UIF as a short-term financial relief whenever they are unemployed or unable to work. You can access the funds only if you have contributed to the fund for a required period and are no longer employed or cannot work due to illness, temporary disability, injuries, maternity/paternity leave, adoption leave, or death. One can get dependent benefits if a working parent or spouse dies.

UIF calculator: How do you calculate a UIF claim?

You must have applied to the fund and taken the necessary steps to claim the benefits when needed. After paying your contributions promptly, below are the steps to follow to calculate UIF claims:

- UIF calculates your average monthly salary for the last 6 months before you claimed your benefits. UIF caps salary at R17,712.

- Therefore, calculate your average monthly salary using this formula: (Your monthly salary x 6 months) / 6 months

- Calculate your daily earnings using the formula: (Average monthly salary x 12 months) / 356 days

- The UIF payout system uses the Income Replacement Rate (IRR) formula to calculate your Daily Benefit Amount (DBA). The IRR formula is 29.2 + (7173.92/ (232.92 +Y1)

- IRR is the percentage of your daily income you are entitled to as UIF benefits. IRR is 38 % minimum and 60% maximum of your daily income.

- Calculate your daily UIF benefits using this formula: IRR x your daily income

- Your total UIF benefit amount is your daily benefit amount multiplied by your available credit days. Credit days are accumulated as follows: If you have contributed for four years or more, you can claim one day for every four days you worked. If you have contributed for a shorter period, you can claim one day for every six days you worked while contributing to the fund.

- UIF policy stipulates that you should contribute for more than four years to get your 365 days' benefits.

Example 1:

If you earn R10,000 a month, your benefit amount will be R4,273.57 (in the first year of your contribution to UIF) if you work for 200 weekdays of the year and have contributed to the UIF for less than four years. Below are the calculations:

Steps | Formula | Calculations | Amt |

Average monthly salary | (Monthly salary x 6 months) ÷ 6 months | (10,000 x 6) ÷ 6 | R10,000 |

Average daily wage (Y1) | (Average monthly salary × 12 months) ÷ 365 days | (15000 × 12) ÷ 365 = R328.77 | R328.77 |

Daily Benefit Amount (DBA) | IRR = 29.2 + (7173.92/ (232.92 + Year 1) 29.2+ (7173.92 ÷ (232.92+493.15) = 39% | 39% of Y1 R328.77 × 39% = R192.33 | R128.22 |

Total Annual Benefit Amount | DBA × ((available credit days ÷ 6)) | R128.22 × (200 ÷ 6) = R10,001.16 | R4,273.57 |

The UIF benefit calculations consider your previous earnings and the number of credit days you've accumulated. Credit days are the days you've worked and contributed to the fund, which directly impacts the amount you'll receive. The UIF considers this to ensure that the financial support you get is equitable and proportionate to your contributions.

Source: UGC

UIF maternity calculator: How much will the UIF pay you?

When calculating your UIF maternity payout benefits, note that UIF caps salary at R17,712 and has 121 capped credit days for maternity leave, 70 capped credit days for adoption leave, and 10 capped credit days for paternity leave.

Example 1:

If your salary is R15,000 and you get paid R10,000 on maternity leave, you will receive R3,313.99 total UIF benefits (in the first year of your contribution to UIF) if you work for 125 weekdays and have contributed to the UIF for less than four years. Here is how to calculate the UIF maternity payout benefits:

Steps | Formula/calculations | Amount |

Average daily income (YI) | (Average monthly salary × 12 months) ÷ 365 days (R15000 × 12) ÷ 365 = R493.15 | R493.15 |

Daily Benefit Amount (DBA) | (IRR rate = 39% of Y1) R493.15 × 66% = R192.33 | R192.33 |

Average daily income (Y2) (leave income) | (Leave income × 12 months) ÷ 365 days (R10,000 × 12) ÷ 365 = R328.77 | R328.77 |

Daily average top-up income | (Y1 – Y2) R493.15 – R328.77 = R164.33 (difference) | R164.33 |

UIF maternity benefits | R164.33 | |

Total UIF maternity benefits | (UIF benefits x (capped credit days ÷ 6)) R164.33 × (121 ÷ 6) = R3,313.99 | R3,313.99 |

N/B

- Where the difference (Y1 – Y2) is less than the Daily Benefit Amount, the difference is paid.

- Where the difference (Y1 – Y2) is more than the Daily Benefit Amount, the DBA maternity benefits are paid.

Example 2:

If your salary is R50,000 and you get R10,000 as maternity leave salary, you get R4,579.85 UIF benefits (in the first year of your contribution to UIF) if you work for 125 weekdays and have contributed to the UIF for less than four years. Here is how to calculate your UIF maternity payout benefits:

Steps | Formula/calculations | Amount |

Monthly avg. income | (Monthly salary × 6 months) ÷ 6 months (R50,000 × 6) ÷ 6 = R50,000 | R50,000 |

Daily avg. income (Y1 uncapped) | (Average monthly salary × 12 months) ÷ 365 days (R50,000 × 12) ÷ 365 days = R1,643.84 | R1,643.84 |

Daily Benefit Amount (DBA) | IRR fixed rate = 39% of Y1 (capped) R582.31 × 39% = R227.10 | R227.10 |

Adjusted avg. daily income (Y2 capped) | (UIF capped salary × 12 months) ÷ 365 days (R17,712 × 12) ÷ 365 days = R582.31 | R582.31 |

Daily top-up income | (Y1 –Y2) R1,643.84 – R582.31 = R1,061.58 | R1,061.58 |

UIF maternity benefit | R227.1009 | |

Total maternity benefit amount | (UIF benefits x applied credit days ÷ 6) R227.1009 x (121 ÷ 6) = R4,579.85 | R4,579.85 |

How is the UIF payout calculated if you have contributed for a short time?

Your benefits will be calculated according to the credits accumulated. The formula for calculating the reduced time benefits is:

- Top-up income = The difference between Reduced Work Time income (per day) and the Daily Benefit Amount (DBA)

Where the difference is less than the daily benefit amount, the difference is paid. The claim will be rejected if the daily income from continued employment is more than the benefit amount.

Source: UGC

UIF contribution calculator: How is UIF contribution calculated?

The UIF contribution must be 2% of the monthly gross salary the employer pays the employee. The employee contributes 1%, and the employer contributes 1% within the prescribed period.

Example 1:

If you earn R15000 monthly, the employer has to deduct R300 and submit it to UIF. You are entitled to a salary of R14700. Here are the calculations:

Employee salary | R15,000 | |

Employer contribution (1%) | 1% × R15,000 | (R150) |

Employee contribution (1%) | 1% × R15,000 | (R150) |

Total UIF contribution (2%) | R300 | |

Salary amount receivable | R14700 |

The amount you will receive as UIF payments will depend on your monthly salary when you were employed. Therefore, you should know how to calculate UIF benefits to know precisely how much you will benefit from the fund.

The contributions employers cut from their employees should be 1% of the worker's monthly salary, excluding commissions. In addition to the 1% the employer should contribute, employers forward another 1%, making the total contribution to the fund 2%.

Example 2:

If a laborer earns R2,000 a month, the employee must deduct 1% of the salary, which is R20, and the employer must also pay an extra R20 for the worker. Therefore, the total amount paid to UIF South Africa is R40, while the employee gets R1,960.

The laborer must contribute to the fund if they earn more than the annual, monthly, or weekly maximum earnings ceiling.

Example 3:

If a worker earns R10,000 a month and their monthly earning ceiling is R1,096, their contribution will be deducted from the R8,836.

Employers cannot deduct more than 1% of the employees’ salaries; the extra money must be paid to the workers. Laborers should also know that they will be committing fraud if they still enjoy the benefits while working.

Source: UGC

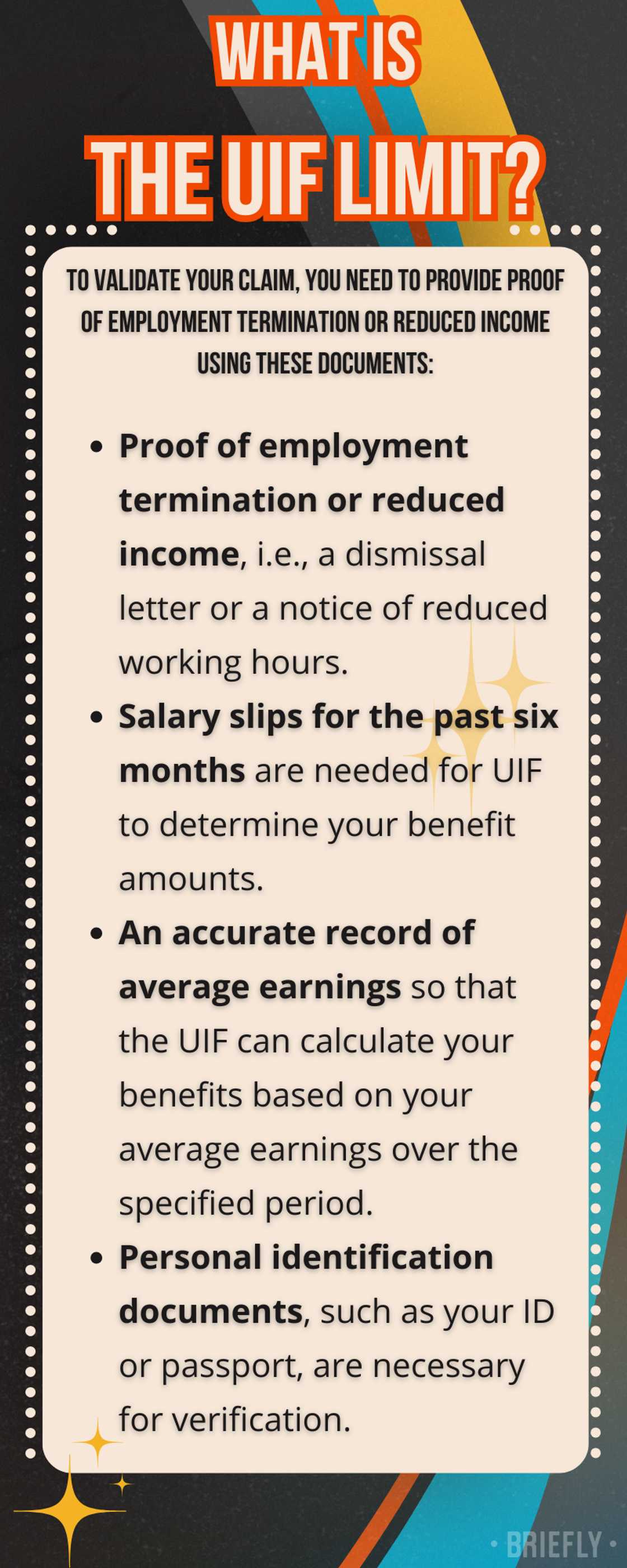

What is the UIF limit?

If you have been making UIF payments for four years or more, you can claim up to 365 days. However, if you have been contributing for less than four years, you can only claim one day out of every five days you worked while contributing to the fund.

To validate your claim, you need to provide proof of employment termination or reduced income using these documents:

- Proof of employment termination or reduced income, i.e., a dismissal letter or a notice of reduced working hours.

- Salary slips for the past six months are needed for UIF to determine your benefit amounts.

- An accurate record of average earnings so that the UIF can calculate your benefits based on your average earnings over the specified period.

- Personal identification documents, such as your ID or passport, are necessary for verification.

How many months do you get paid UIF?

You can claim your UIF benefits for 12 months, provided you have full credit days. Credits accrue as follows: every four days you work, you receive one day's credit, subject to a maximum of 12 months.

How long does UIF pay after signing?

If everything is in order, you should start getting UIF payouts within eight weeks of signing for claims. The money will be paid every four weeks until all the benefits are used up.

How long does a payout take?

The UIF claiming process can take up to three hours, and the first payment will get to your bank account within two to four working days of completion.

You must also make a UIF claim within six months after your last day of employment. The process takes longer to finalize the claim if the employment record is not up to date.

Source: UGC

How long does the UIF second payment take?

After signing the continuation of payment, the second or third payment should be received in 10 working days at most. The duration is used to double-check whether the claimant is still unemployed and to verify other personal details to prevent fraud.

Read also

Mzansi left reeling after Reserve Bank hikes repo rate by 50 basis points to 7.75%: “I can barely survive”

What is the maximum UIF payment?

UIF pays a percentage of your salary while you contribute to the fund, and the highest amount you can receive is 58% of your daily earnings. If you have contributed for four years or more, you can claim one day for every four days you worked. If you have contributed for a shorter period, you can claim one day for every six days you worked while contributing to the fund.

What can you do if your UIF payout takes too long?

Call the Labor Centre where the claim was submitted or request help through the UIF Call center number 0800 843 843. Make sure you have your ID number ready.

Were the UIF contributions increased?

The Minister of Finance increased the monthly maximum remuneration for the Unemployment Insurance Fund contributions to R17,712 from R14,872 monthly. This means that the monthly UIF contributions per respective employer would now be limited to R177.12 per month, up from R148.72 per month.

Who can be exempted from UIF payments?

Every employee should make UIF contributions unless exempted or excluded by the relevant laws. Independent contractors that are deemed to be employees are exempt from UIF contributions. The following instances exempt an employee from UIF contributions:

- Works less than 24 hours every month.

- Learner in terms of the SDL Act.

- Foreigner, leaving South Africa at the end of service.

- Earns commission only.

- Income from a pension, superannuation, or retirement allowance only.

- Public servant (these include the president, any Member of Parliament, or people in any sphere of government service)

Source: UGC

What are the best online UIF calculators?

Online UIF deduction calculators can help you know how much you should contribute to the fund. The same platforms act as UIF payout calculators, determining how much money you can claim against your contributions. Some of these online calculators are:

PAYE Calculator South Africa

The PAYE Calculator helps you calculate Net Income (after PAYE and UIF are deducted).

The ezUIF Benefits Calculator

The ezUIF Benefits Calculator estimates how much UIF you can expect to receive monthly if your application succeeds.

The UIF calculator

The online UIF calculator calculates your payouts along with a guide that explains how to calculate UIF benefits yourself.

The UIF Status Checker

The UIF Status Checker is the ultimate UIF calculator, providing a comprehensive guide for calculating your UIF contributions with ease and accuracy.

If you are registered for this fund and have been making your contributions, this UIF calculator guide can help you determine your benefits.

Source: Original

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

Briefly.co.za featured an informative guide on how to get a tax number from the South African Revenue Service (SARS).

There are two categories of taxpayers: residents and non-residents. Knowing where you fall in helps you get the exemplary SARS service, including your tax number.

Source: Briefly News

Peris Walubengo (Lifestyle writer) Peris Walubengo has vast experience in search engine optimization through digital content generation, research, editing, and proofreading. She joined Briefly.co.za in November 2019 and completed the AFP course on Digital Investigation Techniques. You can email her at perisrodah254@gmail.com.

Cindy Karimi Cindy K. Karimi is a content creator with more than 4 years of experience. She graduated from Kenyatta University studying Records Management and IT in 2021. Cindy has been with Briefly since 2020, covering content, mainly celebrity biographies and list articles. Cindy is a dog lover and enjoys hiking, swimming and jogging. Tel: +254710217889