How to check your Capfin loan statement in 2025: Apply and check your loan status

Capfin is a multi-award-winning credit provider in South Africa. Founded in 2010, the company consistently exceeds customer expectations with friendly service and responsible lending. This financial institution makes applying for a quick loan easy. This article explores how to check your Capfin loan statement in 2025.

Source: UGC

TABLE OF CONTENTS

- Key Takeaways about Capfin loan statements

- How to check your Capfin loan statement in 2025

- Can you apply for a second loan at Capfin?

- How long does Capfin take to approve a loan application?

- Can you check your loan status online?

- How do you check your Capfin loan balance via SMS?

- What is Capfin's balance check number?

- How do you check your remaining loans?

- What is Capfin's self-service number?

Key Takeaways about Capfin loan statements

- Reviewing your Capfin loan statement monthly can help you monitor your spending and current balance. This will enable you to keep track of your loans.

- Consistently reviewing your loan statement also allows you to spot any errors or suspicious/unauthorised transactions on your Capfin account before you encounter significant financial damage.

- If anything looks incorrect or unfamiliar on your loan statements, contact Capfin immediately.

How to check your Capfin loan statement in 2025

An online loan statement, like a traditional loan statement, provides a summary of your loan account activity, including key details like the loan balance, interest rate, payments made, and transaction history. It also includes information about the loan's total amount, outstanding balance, and next loan payment due date. Here is how to check Capfin loan statements:

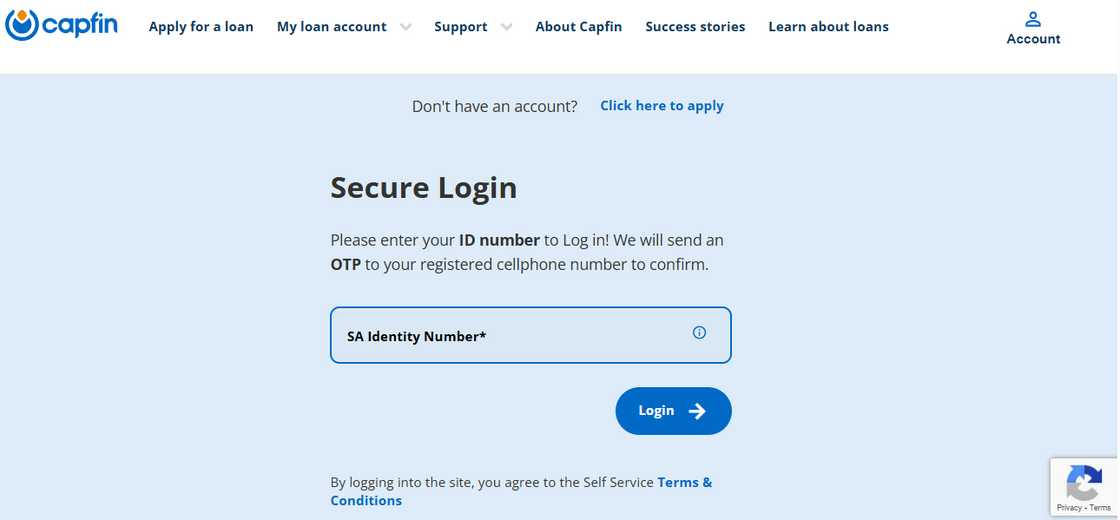

- Visit the official Capfin website.

- Click "Account" in the top right corner of the website.

- Enter your ID number and click "Log in."

Source: UGC

- Capfin will send an OTP to your registered cellphone number to verify your identity.

- After verification, you can view your current and past Capfin loan statements.

What are the Capfin loan requirements?

Capfin provides affordable loans of up to R50,000 with flexible repayment terms. In addition, it gives you unlimited access to your credit account. To qualify for a Capfin loan, individuals must meet these requirements:

- One must possess a valid South African ID.

- Have a valid cell phone number.

- Be 18 years old and above.

- Have your three latest bank statements or salary slips as proof of income.

- Be permanently employed with a monthly salary.

- Possess a valid South African bank account with one of the following banks supported by Capfin: Standard Bank, ABSA, FNB, Nedbank, Capitec, and African Bank.

Capfin online loan application

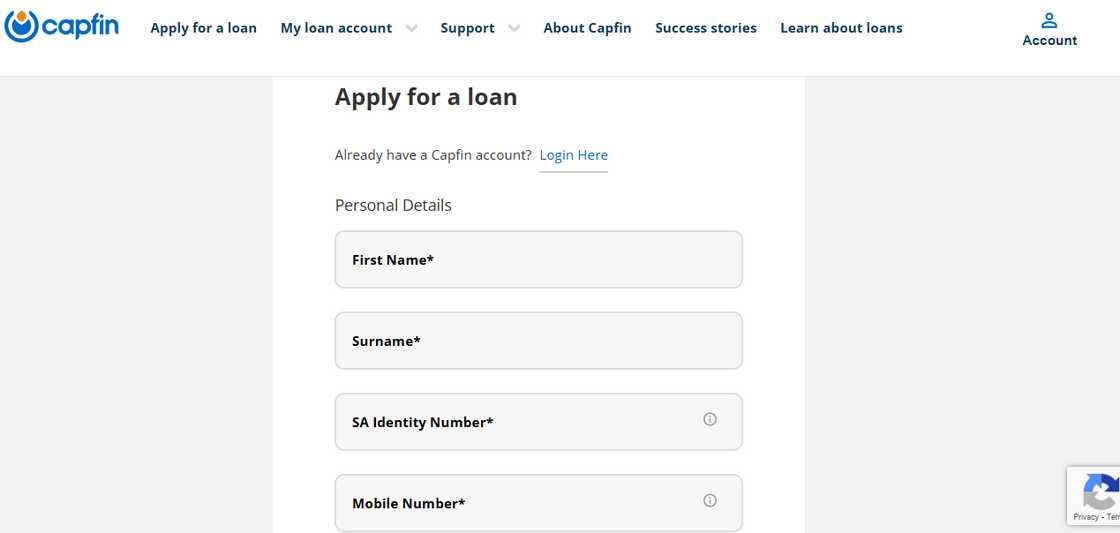

With access to the internet, Capfin's loan application process can be done from wherever you are. Below is a simple step-by-step guide on how to apply seamlessly for Capfin loans:

- Visit the official Capfin website.

- Use Capfin's online loan calculator to estimate your potential repayments and see if you qualify for the loan amount you need.

- Click "Apply Now."

- Read the questions on the window that pops up and click "Yes - Let's Go" if you meet the criteria.

- You will be directed to a form where you should fill in your details.

Source: UGC

- Click on the terms and conditions checkbox.

- Click ‘’Continue,’’ then create your online profile.

- Login to your profile using your ID number, and an OTP will be sent to your registered number.

- Lastly, follow the instructions to complete your loan application.

- Once your loan application has been approved, you can finalize the application by providing banking details and uploading documents.

How long does Capfin take to approve a loan?

Once the credit is approved, you will receive the funds in your bank account within two business days (48 hours). You may also call Capfin on 087 354 0000 to find out if you’ve been approved.

How do you know if your Capfin loan has been approved?

If your loan is approved, Capfin will contact you, typically within 24 hours after they have submitted all the requirements with a credit offer.

How do you know if your Capfin loan has been declined?

If your loan application is rejected, you will receive a call-back or email from Capfin explaining why this happened. Fortunately, you can reapply for this credit after 30 calendar days.

Capfin contact details

You can communicate with Capfin's customer service via:

- Call center: 087 354 0000

- WhatsApp number: 066 000 0683

- SMS: Send the word ‘’Help’’ to 43679 (standard charges apply)

- USSD: 1346454#

- Email: info@capfin.co.za

- FAX: 086 688 0000

Source: UGC

Can you apply for a second loan at Capfin?

You can apply for a second loan at Capfin, but it's subject to their policies and your financial situation. Capfin may have limits on the number of loans an individual can have or the total loan amount. Also, the amount they can lend you per loan application depends on your credit application and affordability assessment.

How long does Capfin take to approve a loan application?

Capfin generally aims to approve loans and make payments to your bank account within 48 hours. The approval process and payout can be expedited if your bank quickly approves the DebiCheck mandate request.

Can you check your loan status online?

You can log into your Capfin account through Capfin's website to check your Capfin loan application status.

How do you check your Capfin loan balance via SMS?

Capfin allows you to check your loan balance via SMS by sending your SA ID number to 44055. You can also use their USSD code 1346454# to get your settlement quote. Additionally, you can log into your online profile via Capfin's website or contact their call center at 087 354 0000 to check your balance.

What is Capfin's balance check number?

To check your Capfin loan balance, you can use the USSD code 1346454#. Alternatively, you can contact Capfin's customer service line at 087 354 0000 or WhatsApp them at 066 000 0683. You can also visit the Capfin website to find more information.

How do you check your remaining loans?

Log into your online profile via Capfin's website, go to loan statements, and choose the desired statement period. The outstanding balance will be displayed alongside the loan account number for reference.

What is Capfin's self-service number?

Capfin does not have a specific self-service number for their loans. For assistance, you can either call their contact center at 087 354 0000, visit their website, capfin.co.za, send a message to Capfin WhatsApp number 066 000 0683, or email them at info@capfin.co.za. Capfin also offers USSD support via 1346454#.

Now that you know how to check your Capfin loan statement in 2025, you can easily plan your monthly budget. This will also help you repay your loan on time.

Briefly.co.za published Pick n Pay's contact details (phone, email, and head office). Pick n Pay has solidified its position as one of South Africa's leading retail giants.

The business caters to the diverse needs of customers nationwide with over 2,000 stores. Check the post for comprehensive information on how to contact the company, depending on your region.

Source: Briefly News

Ruth Gitonga (Lifestyle writer) Ruth Gitonga has a background experience in Mass Communication for over six years. She graduated from the University of Nairobi with a degree in Mass Communication in December 2014. In 2023, Ruth finished the AFP course on Digital Investigation Techniques. She has worked for Briefly.co.za for seven years now. She specializes in topics like lifestyle, entertainment, travel, technology, and sports. Email: gitongaruth14@gmail.com.

Peris Walubengo (Lifestyle writer) Peris Walubengo has vast experience in search engine optimization through digital content generation, research, editing, and proofreading. She joined Briefly.co.za in November 2019 and completed the AFP course on Digital Investigation Techniques. You can email her at perisrodah254@gmail.com.