Can you reverse an unredeemed Capitec Cash Send in SA?

Reversing an unredeemed Capitec Cash Send can save you from potential financial mishaps. You may have made an error in the recipient's details, sent the wrong amount, or simply changed your mind about the process. Find out how you can reverse or cancel an unredeemed Capitec Cash Send in this comprehensive guide.

Source: Twitter

TABLE OF CONTENTS

- What does unredeemed Capitec Cash Send mean?

- How do you get a new PIN for Capitec Cash Send?

- How to check redeemed Capitec Cash Send

- How to withdraw Capitec Cash Send

- FAQs

- Can you reverse Capitec Cash Send with the app?

- How long does it take Capitec to reverse an unredeemed Cash Send?

- Is Capitec Cash Send available to someone outside South Africa?

- What are the Capitec Cash Send limits?

- How much does Capitec Cash Send cost?

- How much to reverse unredeemed Capitec Cash Send?

The Capitec Cash Send service has been a reliable option for quick and convenient money transfers since its introduction. Reversing an unredeemed cash send is also a straightforward process that ensures a safe refund into your account.

What does unredeemed Capitec Cash Send mean?

An unredeemed Capitec Cash Send refers to a situation where money has been sent via Capitec Bank's Cash Send service but has not been claimed by the recipient within the specified timeframe. The cash is supposed to be collected within 30 days.

Capitec Cash Send was designed to allow customers to send money to friends and family, even if they do not have a Capitec Bank account. To send cash, you can use the Capitec App, internet banking, or USSD code *120*3279#.

Source: UGC

Can you reverse an unredeemed Capitec Cash Send?

You can reverse an unredeemed Capitec Cash Send. However, reversal will not be possible if the money has already been withdrawn or if the voucher has been redeemed.

How to reverse unredeemed Capitec Cash Send

Unredeemed Capitec Cash Sends are usually paid back into the sender's account after 30 days. You can also seek early reversal of the funds by;

- Visiting the nearest Capitec Bank partners, including Ackermans, PEP, PEP HOME, PEP CELL, Pick 'n Pay, Boxer, Checkers, Usave, Shoprite or Capitec ATM to collect the cash.

- Visiting the nearest Capitec Bank branch to request a reversal.

- You can contact Capitec Bank's customer care centre on 0860 10 20 43. Inform the agent that you wish to reverse a Cash Send transaction back into your account, and they will guide you through the process.

Remember that reversing a Capitec Cash Send will cost you a non-refundable fee of R160. This amount is charged regardless of whether the cancellation succeeds or fails. Once your reversal request has been made, the cash will be refunded to your account within 24 hours, but it can take longer.

How do you get a new PIN for Capitec Cash Send?

Capitec Bank allows customers to set up a new PIN for the Cash Send service. Here are the steps to update the secret code for unredeemed vouchers;

- Sign in to your Capitec internet banking account.

- Navigate to the Payments menu.

- Select Send Cash.

- Click on View my Send Cash history.

- Choose the unredeemed voucher you want to update.

- Click on Update secret code.

- Enter a new 4-digit secret code.

- Click Continue to confirm the update.

- Open the Capitec Bank app on your phone and approve the authorization message.

Source: UGC

How to check redeemed Capitec Cash Send

You can easily check your redeemed Capitec Cash Send using the internet banking service to keep track of money. Follow these steps;

- Sign in to your internet banking account.

- Go to the Payments menu.

- Select Send Cash.

- Click on View my Send Cash history.

- Here, you will see a list of all your Cash Send transactions, including those that have been redeemed.

How to withdraw Capitec Cash Send

For Capitec Cash Send withdrawal to be successful, one must have the reference number, which is sent by SMS to the sender via WhatsApp, the 4-digit secret code, and a valid South African ID. Recipients will then be required to collect the cash by following these steps;

- Visiting the nearest Capitec Bank partner or Capitec ATM

- At the partner location, tell the cashier that you have a cash transfer from a Capitec customer.

- The cashier will ask for the reference number.

- You will also be asked for the secret code and personal details like your full name and cellphone number.

- Once verified, you will receive the cash sent to you. You will not be charged any fee when collecting cash.

Source: Getty Images

FAQs

Capitec Cash Send is one of the most popular services offered by the bank due to factors like convenience, wide accessibility, and free collection. Here are some of the frequently asked questions about the service;

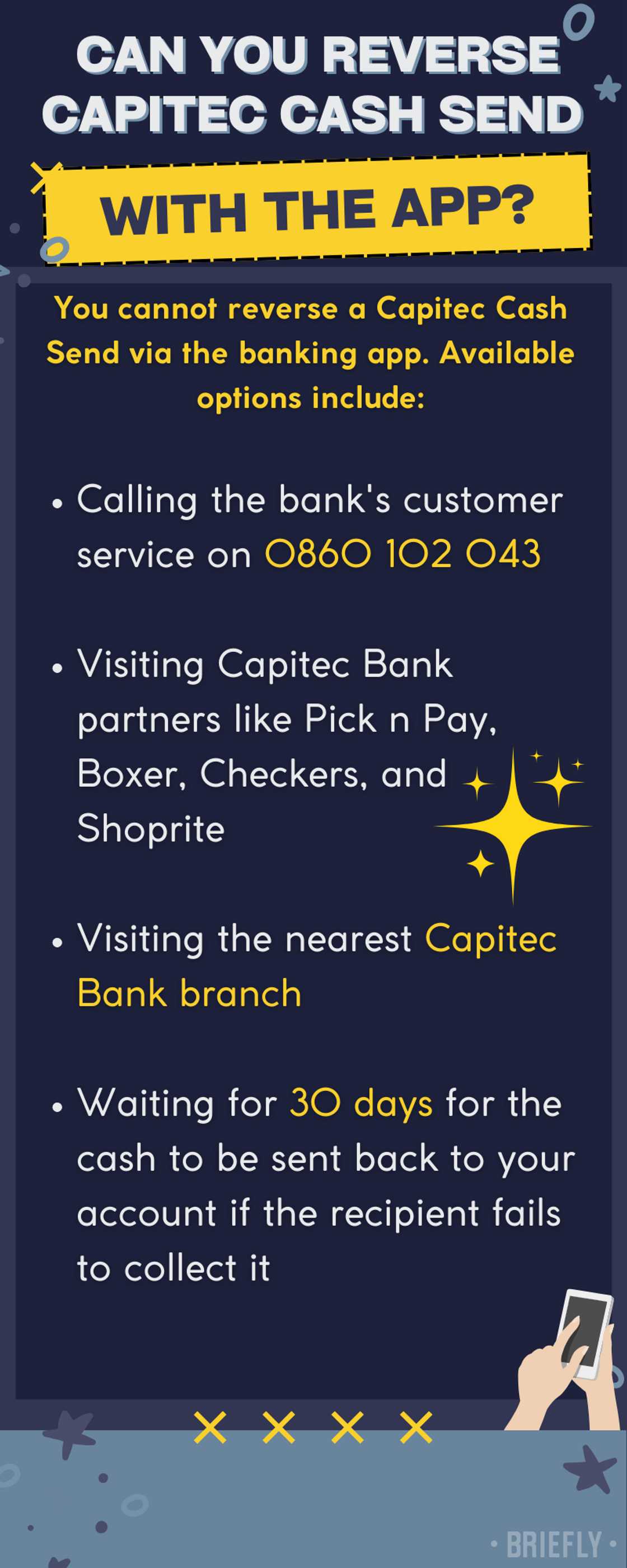

Can you reverse Capitec Cash Send with the app?

You cannot reverse a Capitec Cash Send via the banking app. Available options include;

- Calling the bank's customer service on 0860 102 043

- Visiting Capitec Bank partners like Pick n Pay, Boxer, Checkers, and Shoprite.

- Visiting the nearest Capitec Bank branch

- Waiting for 30 days for the cash to be sent back to your account if the recipient fails to collect it.

How long does it take Capitec to reverse an unredeemed Cash Send?

Reversed funds can take up to 24 hours to show up in your account if the reversal is successful. It can take longer in certain cases.

Is Capitec Cash Send available to someone outside South Africa?

The service is currently unavailable to people living outside Mzansi. Only South African citizens can use Capitec Cash Send.

What are the Capitec Cash Send limits?

The limits depend on whether you are using the app, the USSD code or internet banking. If you are sending via the USSD code *120*3279#, the limit per transaction is R1000, the daily limit is R1000, and the monthly limit is R24,990.

If you will be sending via the Capitec bank or Internet banking, the maximum limit per transaction is R3,000, the limit per day is R5000, and the monthly limit is R24,990.

How much does Capitec Cash Send cost?

The cost of using Capitec Cash Send in South Africa depends on the amount you are sending:

- R40 - R1000: R10 per transaction

- R1010 - R3000: R16 per transaction

Collecting the cash is free at partner locations like Pick n Pay, Boxer, Checkers, Usave, Shoprite, and Capitec ATMs.

How much to reverse unredeemed Capitec Cash Send?

There is a non-refundable fee of R160.00 to reverse an unredeemed Capitec Cash Send. This fee applies regardless of whether the reversal is successful or not.

Source: Getty Images

Learning how to reverse unredeemed Capitec Cash Send offers peace of mind and provides a convenient way to retrieve unclaimed money. The process is easy, as highlighted above, but there are costs involved.

Source: Original

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions. Any action you take based on the information presented in this article is strictly at your own risk and responsibility!

READ ALSO: Which stores accept Identity cards for shopping in South Africa?

Briefly.co.za shared all you need to know about the stores that accept Identity cards for shopping. Identity is one of the leading fashion brands in South Africa.

Identity currently operates under the Truworths International Retail Group alongside other brands like YDE and Uzzi. Check the article for more on which stores will allow you to use your Identity card to shop.

Source: Briefly News