How to increase limits on Capitec: USSD, app, and ATM in 2024

Technology has made the banking experience simpler. Whether you have an internet-enabled mobile device or not, you can bank on the go. Capitec has such services available for clients, making it easy for them to bank using the USSD code. This is why you should learn how to increase limits on Capitec for an easier experience.

Source: UGC

TABLE OF CONTENTS

Do you need to know how to increase the limit on Capitec? In that case, you should know that there are several ways to go about it, depending on the accessibility of the internet and how vast you are with technology. The steps below walk you through the process without struggle.

How to increase limits on Capitec

Whether you opt for contactless payments, QR code scanning, online shopping, or withdrawing cash, understanding your card limits and how to customize them can enhance your ability to make secure transactions and avoid unnecessary fees. Below are various ways how you can increase your card limit.

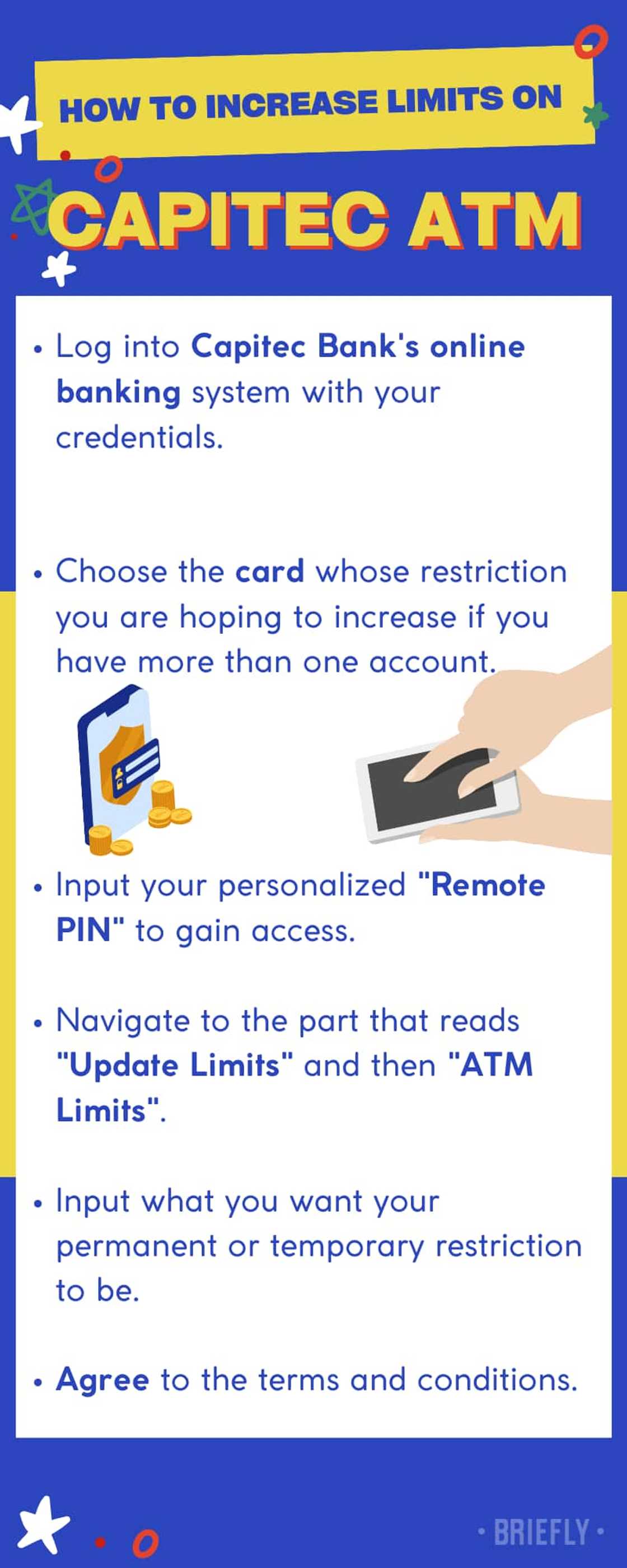

1. How to increase limits on Capitec ATM

You increase the limit on Capitec ATM only if you hope to withdraw more than the ATM default restriction urgently. If it is urgent and compulsory that you must do it, below is how to increase limits on Capitec card to withdraw up to R1,000,000:

- Log into Capitec Bank's online banking system with your credentials.

- Choose the card whose restriction you are hoping to increase if you have more than one account.

- Input your personalized "Remote PIN" to gain access.

- Navigate to the part that reads "Update Limits" and then "ATM Limits".

- Input what you want your permanent or temporary restriction to be.

- Agree to the terms and conditions.

It is important to note that Capitec Bank will never allow you to make your permanent restriction above your default ATM limit, which is R50,000. Anything you choose above will be a temporary restriction that will only be usable for three days, after which it reverts to the default restriction. Similarly, your temporary limit can never exceed R1,000,000.

These restrictions above protect you from falling prey to online fraud because the higher you place your restriction, the higher the risk of getting large amounts of your bank funds stolen from you.

Therefore, it is mostly advised that you keep your bank restrictions on the default for your Internet banking and apps. It will help reduce the risk of being defrauded when your computer and mobile phone fall into the hands of dishonest people.

2. How to increase limits on Capitec app

Source: UGC

The first step is to download the app and register if you are interested in knowing how to increase the limit on Capitec app. Once done, proceed to the app and follow the instructions below to increase your daily limit:

- Log into your Capitec app on your phone.

- Access your personal account by inputting your secret Remote PIN.

- Select the preferred card (if you have more than one card) that you would want to have increased restrictions.

- Toggle on the “Update Limits” option.

- Click on "Update".

- Input the daily restrictions for your telephone, mail, online, and whatever purchases you are responsible for every day.

- Read through the agreement that follows, as this will let you know the terms and conditions of what you are doing.

- Consent to the agreement if you find it appropriate to your needs.

Can you increase the limit on the Capitec app?

Yes, though there are three authentication modes, whether you are updating your Capitec restriction on an app or through the Internet banking systems. The authentication process is required to confirm that you are the person authorising the changes to your default restrictions.

In-app authentication

If you have access to the app on your device, then follow these steps:

- You will get a notification on your app after you have checked out.

- Then, you can choose among different options: Approve, Cancel or Suspect fraud.

- Afterwards, input your Remote PIN to authenticate the transaction.

USSD authentication

If you do not have access to an internet connection or the app, note that a USSD push notification to help verify the authentication of your transaction will be sent to the mobile number linked to your Capitec account during registration. In this case, reply to the message with any of the following:

- 1 to Approve

- 2 to Cancel and

- 99 if you suspect fraud

SMS OTP (One-time password)

This service is also useful if you are doing the process on a mobile phone that cannot access the internet.

- You will receive a 6-digit OTP as a text message on your Capitec Bank-registered mobile number, which you can only use once;

- Input this PIN to authenticate the transaction.

3. How to increase limits on Capitec cellphone banking

If you are wondering how do you increase your Capitec daily limit without the app? The best way to do that is to visit any branch of the Capitec bank around you. If you have a phone that can only send and receive text messages, you can access any of the services provided through the USSD push notification, which is *120*3279#.

If you have already exhausted your phone airtime, dialling *130*3279# will help you recharge your phone without worries about charges because it is a free process.

4. Does Capitec allow credit card limit increases online?

Source: UGC

Apart from using the app, you can also increase your limit using internet banking. Here is how to increase limits on Capitec online banking platform.

- Visit the official Capitec online banking platform.

- Sign in with your password/Remote PIN.

- Click "View My List of Cards".

- Select the relevant card.

- Click "Update Daily Card Limits".

- Enter your permanent/temporary daily limit for online/telephone/mail purchases.

- Accept the agreement by clicking "Update Daily Card Limits".

5. How do you increase your daily limit on Capitec USSD?

Unfortunately, you cannot directly increase your Capitec transaction limits through the USSD service itself. You visit your nearest Capitec branch and speak to a service consultant.

What is tap to pay?

Tap to pay is a swift and convenient payment method that utilizes secure contactless technology. By tapping your card on any contactless-enabled card machine, you can effortlessly make purchases of up to R500 without the need to enter your PIN. This feature becomes active once you've initiated the tap-to-pay process.

How do you increase your Capitec tap limit?

Capitec doesn't allow increasing the current R500 daily limit for tap-to-pay transactions.

How do you change your debit card limit?

You can change your debit card limit through the Capitec online banking platform, using their app or visiting your nearest branch.

Is there a limit on Capitec transfers?

The daily Capitec transfer limit is R100,000. You will incur an immediate payment fee of R7.50 per transaction.

What are Capitec's daily limits?

The following are the set daily limits.

Limit type | Daily limit | Temporary limit |

Cash withdrawal | R5,000 | R10,000 |

Card machine purchase | R50,000 | R1,000,000 |

Online shopping/scan to pay/telephone/mail order | R50,000 | R1,000,000 |

What are Capitec's temporary limits?

Temporary limits can be adjusted to accommodate purchases beyond your regular spending.

Limit type | Maximum limit |

Temporary cash withdrawal | R10,000 |

Temporary card machine purchase | R1,000,000 |

Online shopping/scan to pay/telephone/mail order | R1,000,000 |

Knowing how to increase the limits on Capitec USSD follows pretty straightforward processes, not minding what medium you use to achieve that. Nevertheless, do not forget that keeping your transaction restrictions as low as possible is usually more advisable because this will help reduce your susceptibility to fraud.

Source: Original

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

Briefly.co.za recently published an article about Investec branch code and universal branch code. Having the Investec branch code on hand helps make online payments fast and simple for those needing to pay people who are with the bank.

Universal codes allow you to make a quick transaction without looking up each branch code online. Read on to find out more about Investec branch codes you can use anytime.

Source: Briefly News

Favour Adeaga (Lifestyle writer) Dr. Favour Adeaga is an author, speaker, and coach. He graduated with a degree in Mass Communication from The Polytechnic, Ibadan, Nigeria. He did his internship at The Nation Newspaper and taught diploma students in Newspaper and Magazine courses at the Nasarawa State University, Keffi. He has curated the facts and life hacks category since 2018. Dr Favour is the author of several books available on Amazon. He currently lives in Nigeria. Email: favouradeaga@gmail.com

Adrianna Simwa (Lifestyle writer) Adrianna Simwa is a content writer at Briefly.co.za, where she has worked since mid-2022. She has written for many periodicals on a variety of subjects, including news, celebrities, and lifestyle, for more than three years. She has worked for The Hoth, The Standard Group and Triple P Media. Adrianna graduated from Nairobi University with a Bachelor of Fine Arts (BFA) in 2020. In 2023, Adrianna finished the AFP course on Digital Investigation Techniques. You can reach her through her email: adriannasimwa@gmail.com